Answered step by step

Verified Expert Solution

Question

1 Approved Answer

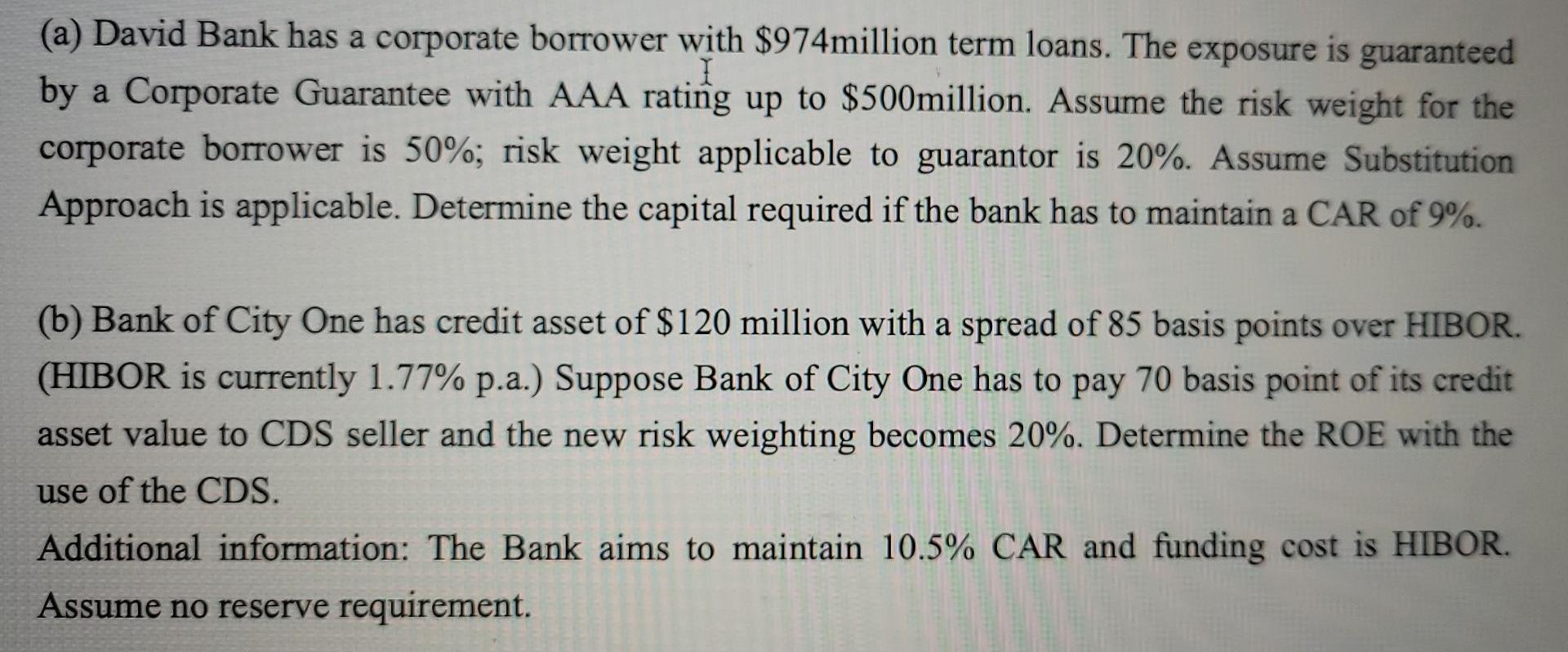

(a) David Bank has a corporate borrower with $974million term loans. The exposure is guaranteed I by a Corporate Guarantee with AAA rating up

(a) David Bank has a corporate borrower with $974million term loans. The exposure is guaranteed I by a Corporate Guarantee with AAA rating up to $500million. Assume the risk weight for the corporate borrower is 50%; risk weight applicable to guarantor is 20%. Assume Substitution Approach is applicable. Determine the capital required if the bank has to maintain a CAR of 9%. (b) Bank of City One has credit asset of $120 million with a spread of 85 basis points over HIBOR. (HIBOR is currently 1.77% p.a.) Suppose Bank of City One has to pay 70 basis point of its credit asset value to CDS seller and the new risk weighting becomes 20%. Determine the ROE with the use of the CDS. Additional information: The Bank aims to maintain 10.5% CAR and funding cost is HIBOR. Assume no reserve requirement.

Step by Step Solution

★★★★★

3.59 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The riskadjusted assets Risk weight of guarantor guaranteed amt Risk weight of borrower ung...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started