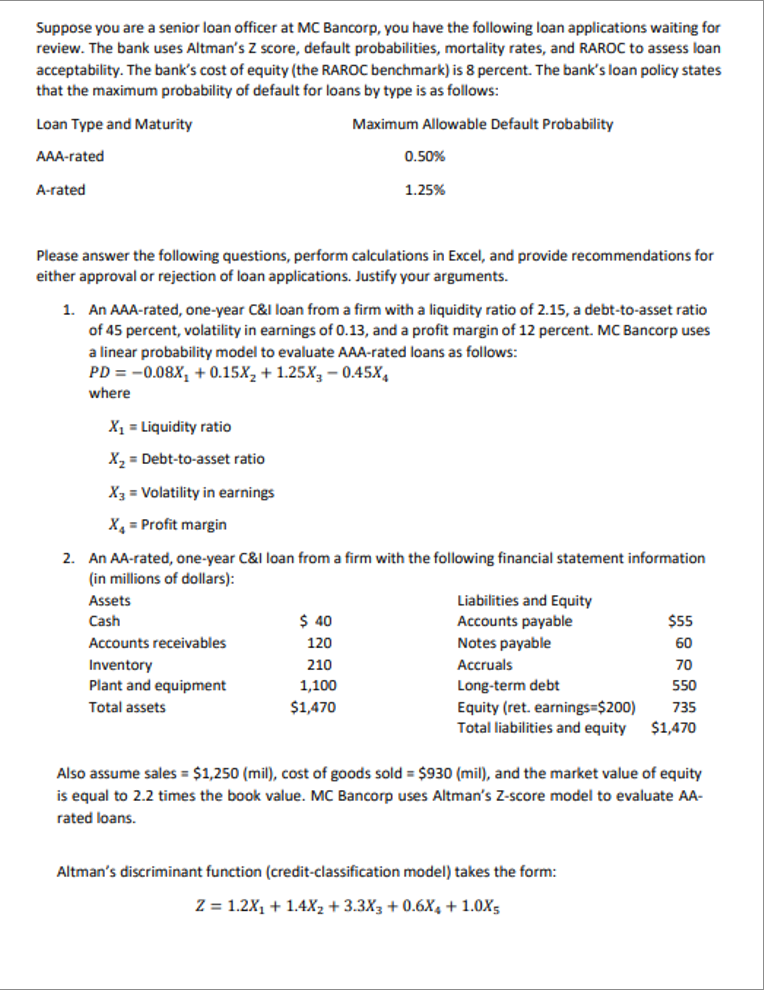

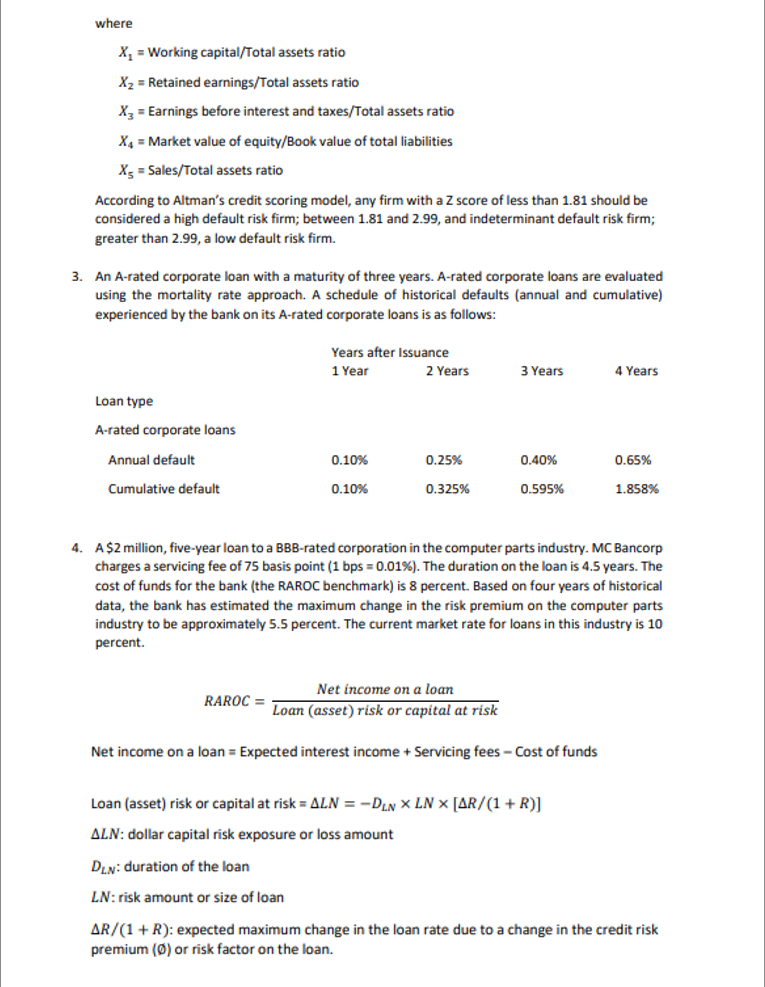

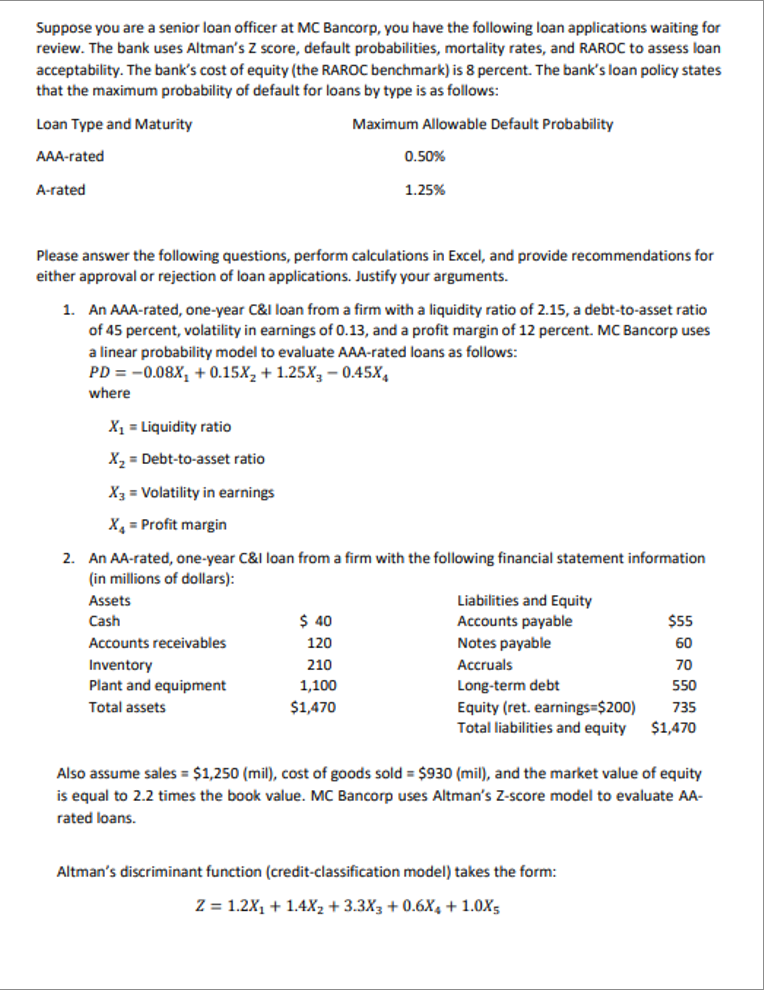

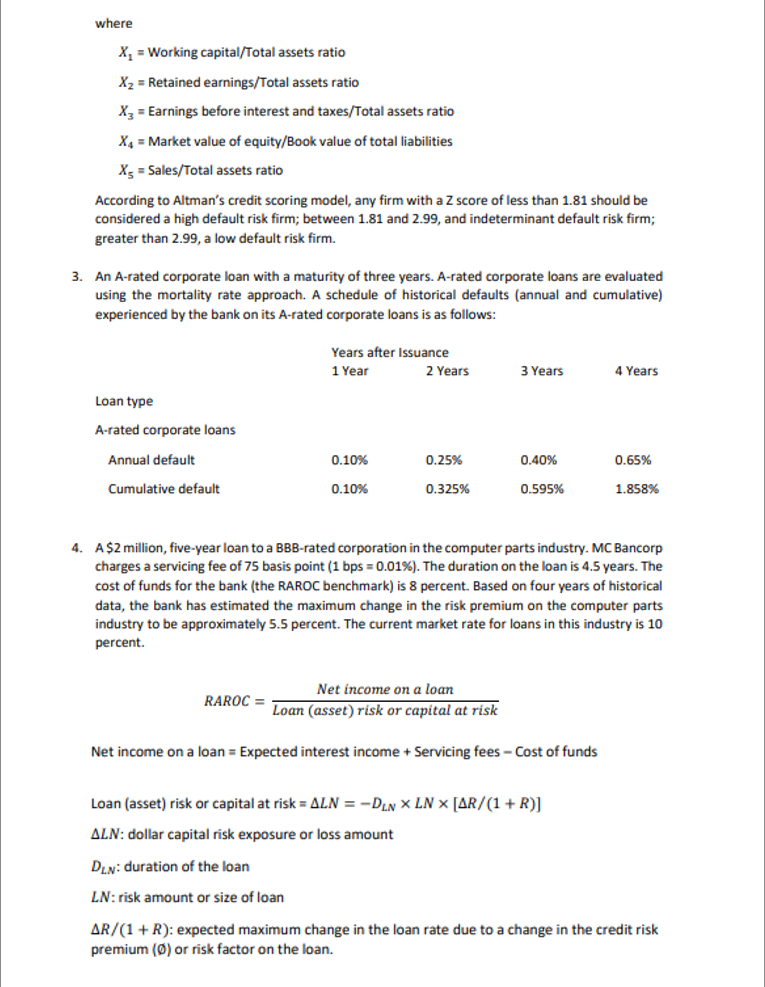

Suppose you are a senior loan officer at MC Bancorp, you have the following loan applications waiting for review. The bank uses Altman's Z score, default probabilities, mortality rates, and RAROC to assess loan acceptability. The bank's cost of equity (the RAROC benchmark) is 8 percent. The bank's loan policy states that the maximum probability of default for loans by type is as follows: bility Please answer the following questions, perform calculations in Excel, and provide recommendations for either approval or rejection of loan applications. Justify your arguments. 1. An AAA-rated, one-year C&l loan from a firm with a liquidity ratio of 2.15 , a debt-to-asset ratio of 45 percent, volatility in earnings of 0.13 , and a profit margin of 12 percent. MC Bancorp uses a linear probability model to evaluate AAA-rated loans as follows: PD=0.08X1+0.15X2+1.25X30.45X4 where X1=LiquidityratioX2=Debt-to-assetratioX3=VolatilityinearningsX4=Profitmargin 2. An AA-rated, one-year C\&l loan from a firm with the following financial statement information (in millions of dollars): Also assume sales =$1,250 (mil), cost of goods sold =$930 (mil), and the market value of equity is equal to 2.2 times the book value. MC Bancorp uses Altman's Z-score model to evaluate AArated loans. Altman's discriminant function (credit-classification model) takes the form: Z=1.2X1+1.4X2+3.3X3+0.6X4+1.0X5 where X1= Working capital/Total assets ratio X2= Retained earnings/Total assets ratio X3= Earnings before interest and taxes/Total assets ratio X4= Market value of equity/Book value of total liabilities X5= Sales/Total assets ratio According to Altman's credit scoring model, any firm with a Z score of less than 1.81 should be considered a high default risk firm; between 1.81 and 2.99 , and indeterminant default risk firm; greater than 2.99, a low default risk firm. 3. An A-rated corporate loan with a maturity of three years. A-rated corporate loans are evaluated using the mortality rate approach. A schedule of historical defaults (annual and cumulative) experienced by the bank on its A-rated corporate loans is as follows: 4. A \$2 million, five-year loan to a BBB-rated corporation in the computer parts industry. MC Bancorp charges a servicing fee of 75 basis point ( 1bps=0.01% ). The duration on the loan is 4.5 years. The cost of funds for the bank (the RAROC benchmark) is 8 percent. Based on four years of historical data, the bank has estimated the maximum change in the risk premium on the computer parts industry to be approximately 5.5 percent. The current market rate for loans in this industry is 10 percent. RAROC=Loan(asset)riskorcapitalatriskNetincomeonaloan Net income on a loan = Expected interest income + Servicing fees - Cost of funds Loan (asset) risk or capital at risk =LN=DLNLN[R/(1+R)] LN : dollar capital risk exposure or loss amount DLN: duration of the loan LN : risk amount or size of loan R/(1+R) : expected maximum change in the loan rate due to a change in the credit risk premium () or risk factor on the loan