Question

The following table supplies data on earnings per share (EPS), book value per share (BVPS), and the Beta Inc.'s return on equity (ROE). Beta

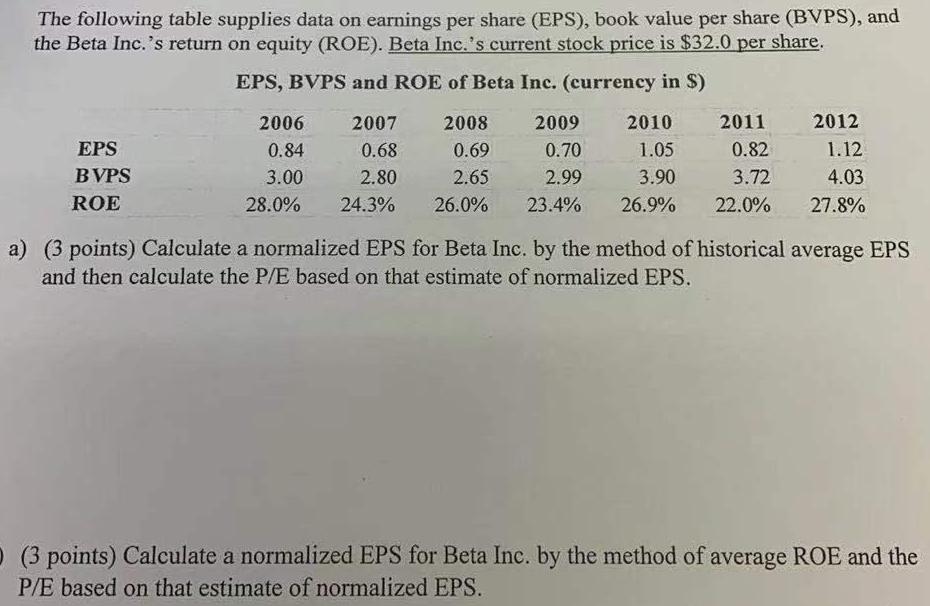

The following table supplies data on earnings per share (EPS), book value per share (BVPS), and the Beta Inc.'s return on equity (ROE). Beta Inc.'s current stock price is $32.0 per share. EPS, BVPS and ROE of Beta Inc. (currency in S) 2006 2007 2008 2009 2010 2011 2012 EPS 0.84 0.68 0.69 0.70 1.05 0.82 1.12 BVPS 3.00 2.80 2.65 2.99 3.90 3.72 4.03 ROE 28.0% 24.3% 26.0% 23.4% 26.9% 22.0% 27.8% a) (3 points) Calculate a normalized EPS for Beta Inc. by the method of historical average EPS and then calculate the P/E based on that estimate of normalized EPS. (3 points) Calculate a normalized EPS for Beta Inc. by the method of average ROE and the P/E based on that estimate of normalized EPS.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

b A B C D E F G H I 5 6 Nor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

20th Edition

1259157148, 78110874, 9780077616212, 978-1259157141, 77616219, 978-0078110870

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App