Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are constructing a portfolio of two companies. The first has 10,000 shares outstanding at a current price of $100 per share, while

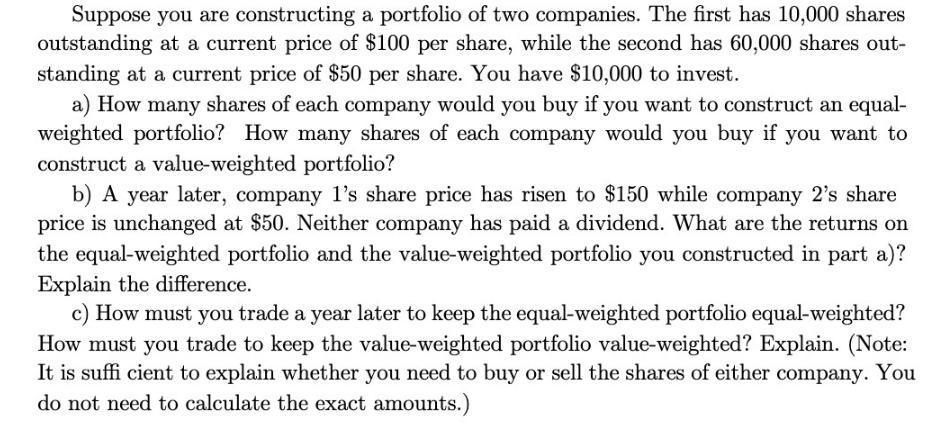

Suppose you are constructing a portfolio of two companies. The first has 10,000 shares outstanding at a current price of $100 per share, while the second has 60,000 shares out- standing at a current price of $50 per share. You have $10,000 to invest. a) How many shares of each company would you buy if you want to construct an equal- weighted portfolio? How many shares of each company would you buy if you want to construct a value-weighted portfolio? b) A year later, company 1's share price has risen to $150 while company 2's share price is unchanged at $50. Neither company has paid a dividend. What are the returns on the equal-weighted portfolio and the value-weighted portfolio you constructed in part a)? Explain the difference. c) How must you trade a year later to keep the equal-weighted portfolio equal-weighted? How must you trade to keep the value-weighted portfolio value-weighted? Explain. (Note: It is suffi cient to explain whether you need to buy or sell the shares of either company. You do not need to calculate the exact amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started