Answered step by step

Verified Expert Solution

Question

1 Approved Answer

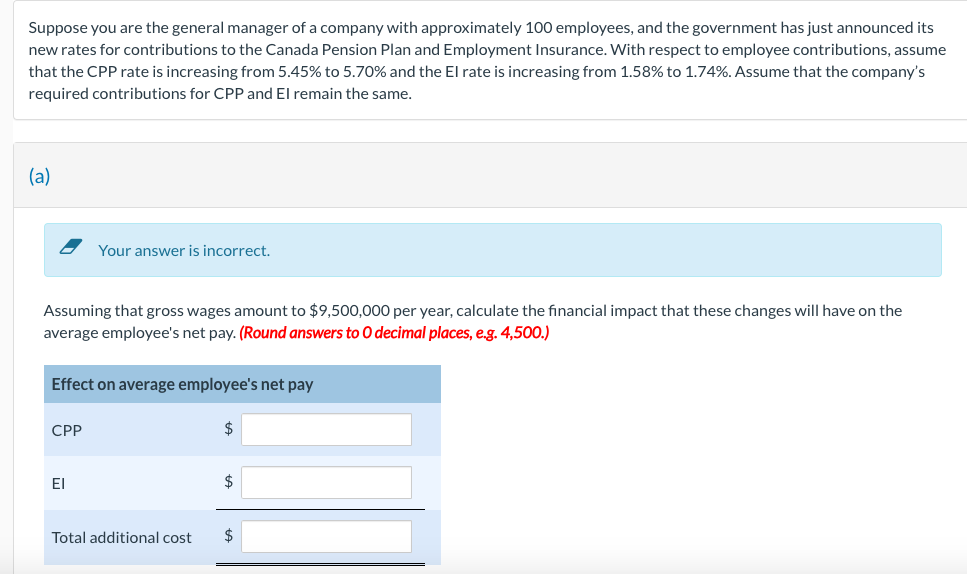

Suppose you are the general manager of a company with approximately 1 0 0 employees, and the government has just announced its new rates for

Suppose you are the general manager of a company with approximately employees, and the government has just announced its new rates for contributions to the Canada Pension Plan and Employment Insurance. With respect to employee contributions, assume that the CPP rate is increasing from to and the El rate is increasing from to Assume that the company's required contributions for CPP and El remain the same. Assuming that gross wages amount to $ per year, calculate the financial impact that these changes will have on the average employee's net pay. Assuming that gross wages amount to per year, calculate the financial impact that these changes will have on the company's payroll costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started