Question

Suppose you are trading derivatives on natural gas and you simultaneously execute the following transactions: Sell a forward contract at a price of $4.78

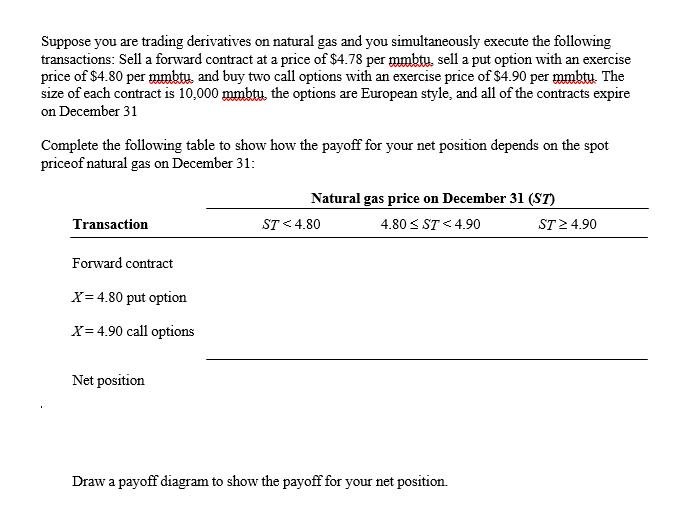

Suppose you are trading derivatives on natural gas and you simultaneously execute the following transactions: Sell a forward contract at a price of $4.78 per mmbtu, sell a put option with an exercise price of $4.80 per mmbtu, and buy two call options with an exercise price of $4.90 per mmbtu. The size of each contract is 10,000 mmbtu, the options are European style, and all of the contracts expire on December 31 Complete the following table to show how the payoff for your net position depends on the spot price of natural gas on December 31: Transaction Forward contract X= 4.80 put option X=4.90 call options Net position Natural gas price on December 31 (ST) 4.80 ST < 4.90 ST < 4.80 Draw a payoff diagram to show the payoff for your net position. ST 4.90

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App