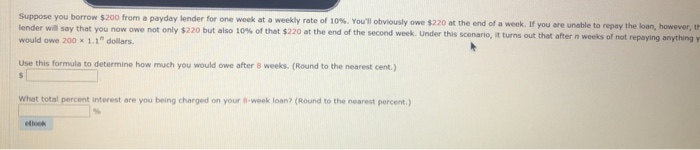

Suppose you borrow $200 from a payday lender for one week at a weekly rate of 10%. You'll obviously owe $220 at the end of a week. If you are unable to repay the loan, however, lender w ay that you now owe not only $220 but also 10% of that $220 at the end of the second week. Under this scenario, it turns out that after weeks of not repaying anything would owe 200 x 1.1" dollars Use this formula to determine how much you would owe after 8 weeks. (Round to the nearest cent.) What total percent interest are you being charged on your a-wook loan? (Round to the nearest percent.) Used by permission of Josh Wallach, Payday Loans Online Resource If you are strapped for cash and are considering I taking out a payday loan, there are several things you should first consider, such as how high the fees and interest rates associated with your loan are. Oftentimes with payday loans, the rates are much higher than other types of loans, and can end up putting you more in debt than you were to start with. Payday loans typically range from approximately $100 to $1000, depending upon your state's legal min- imum. The average loan time is two weeks, after which time you would have to repay the loan along with the fees and interest you accrued over that period. These loans usually cost 400% annual interest (APR), if not more. And the finance charge to borrow $100 ranges from $15 to $30 for two-week loans. These finance charges are sometimes accompanied by interest rates ranging from 300% to 750% APR. For loans shorter than two weeks, the APR can be even higher. In most cases, payday loans are much more expen- sive than other cash loans. For example, a $500 cash advance on an average credit card that is repaid in one month would cost you $13.99 in finance charges and an annual interest rate of about 5.7%. A payday loan, on the other hand, would cost you $17.50 per $100 for borrowing the same $500, and would cost $105 if renewed once. or 400% annual interest. Used by permission of Josh Wallach. Payday Loans Online Resource