Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you bought a 10-year US Treasury bond with a 1% coupon rate and 1% yield to maturity on Jan 1, 2022. On Jan

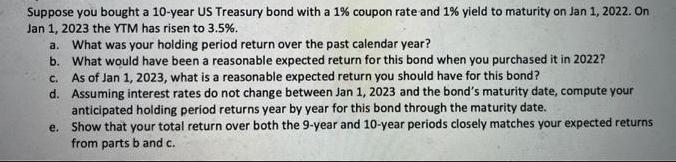

Suppose you bought a 10-year US Treasury bond with a 1% coupon rate and 1% yield to maturity on Jan 1, 2022. On Jan 1, 2023 the YTM has risen to 3.5%. a. What was your holding period return over the past calendar year? b. What would have been a reasonable expected return for this bond when you purchased it in 2022? C. As of Jan 1, 2023, what is a reasonable expected return you should have for this bond? d. Assuming interest rates do not change between Jan 1, 2023 and the bond's maturity date, compute your anticipated holding period returns year by year for this bond through the maturity date. Show that your total return over both the 9-year and 10-year periods closely matches your expected returns from parts b and c. e.

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the holding period return over the past calendar year we need to take into account the coupon payment received and the capital gainloss ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started