Answered step by step

Verified Expert Solution

Question

1 Approved Answer

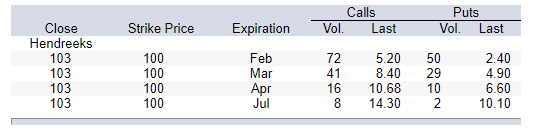

Suppose you buy 40 March 100 put option contracts. What is your maximum gain? On the expiration date, Hendreeks is selling for $84.90 per share.

Suppose you buy 40 March 100 put option contracts. What is your maximum gain? On the expiration date, Hendreeks is selling for $84.90 per share. (Please round your answer to 2 decimal places.)

- What is the cost of contracts? (1pt)

- How much is the payoff per share? (1pt)

- What is the terminal value of your investment? (2pt)

- What is your net gain? (3pt)

- What is the maximum gain you can get from your investment? (3pt)

PLEASE SHOW WORK

Calls Vol. Last Strike Price Expiration Puts Vol. Last Close Hendreeks 103 103 103 103 100 100 100 100 Feb Mar Apr Jul 72 41 16 8 5.20 8.40 10.68 14.30 50 29 10 2 2.40 4.90 6.60 10.10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started