Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you constructed an option portfolio on the 1-year S&P index that include (i) short 1 put contract at K = 1500, (ii) long

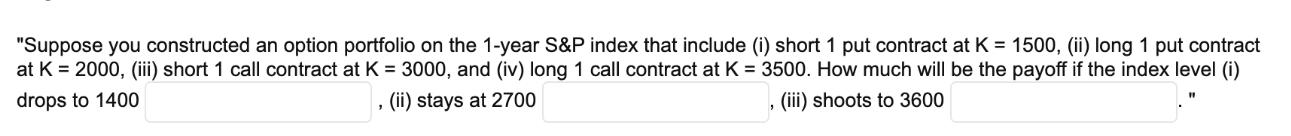

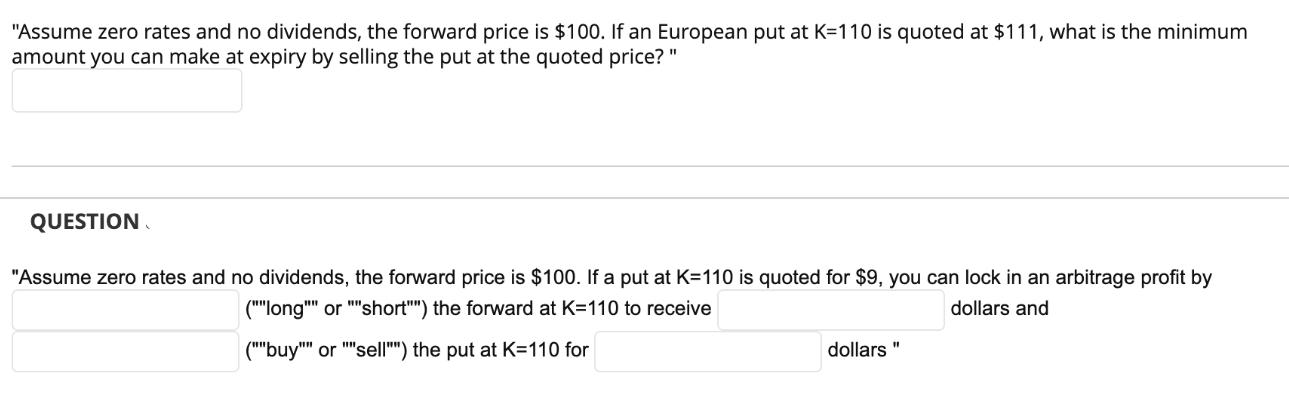

"Suppose you constructed an option portfolio on the 1-year S&P index that include (i) short 1 put contract at K = 1500, (ii) long 1 put contract at K = 2000, (iii) short 1 call contract at K = 3000, and (iv) long 1 call contract at K = 3500. How much will be the payoff if the index level (i) drops to 1400 , (ii) stays at 2700 , (iii) shoots to 3600 "Assume zero rates and no dividends, the forward price is $100. If an European put at K=110 is quoted at $111, what is the minimum amount you can make at expiry by selling the put at the quoted price? " QUESTION "Assume zero rates and no dividends, the forward price is $100. If a put at K=110 is quoted for $9, you can lock in an arbitrage profit by (""long"" or ""short"") the forward at K=110 to receive dollars and (""buy"" or ""sell"") the put at K=110 for dollars "

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

It appears that youve presented two separate questions regarding options trading Lets address each one separately For the first question You have constructed an options portfolio with the following po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started