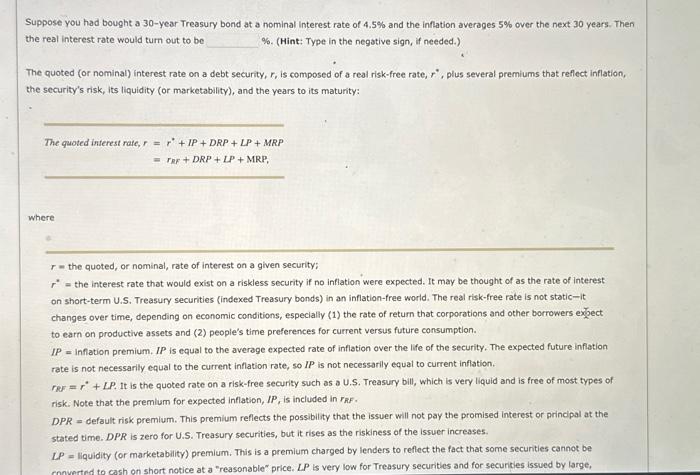

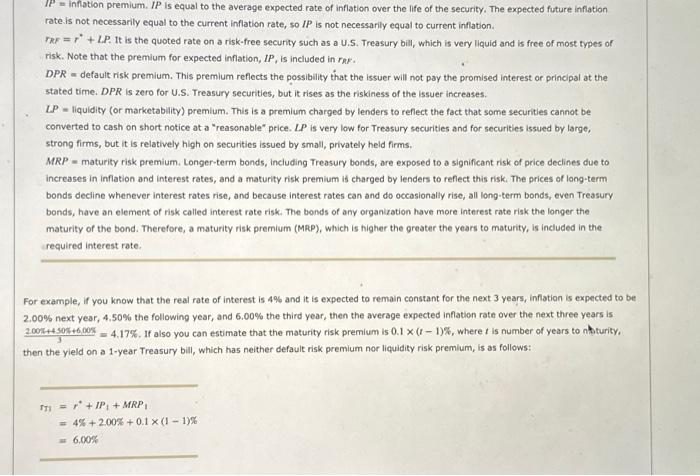

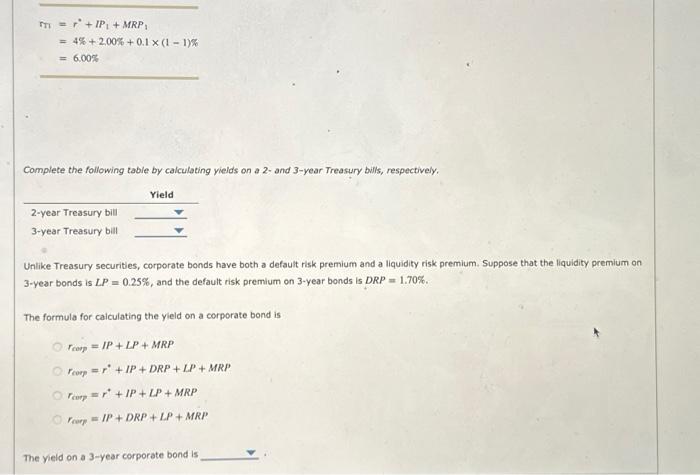

Suppose you had bought a 30-year Treasury bond at a nominal interest rate of 4.5% and the inflation averages 5% over the next 30 years. Then the real interest rate would turn out to be \%. (Hint: Type in the negative sign, if needed.) The quoted (or nominal) interest rate on a debt security, r, is composed of a real risk-free rate, r, plus several premiums that reflect inflation, the security's risk, its liquidity (or marketability), and the years to its maturity: The quoted interest rate, r=r+IP+DRP+LP+MRP =rRF+DRP+LP+MRP, where r= the quoted, or nominal, rate of interest on a given security; r= the interest rate that would exist on a riskless security if no inflation were expected. It may be thought of as the rate of interest on short-term U.S. Treasury securities (indexed Treasury bonds) in an inflation-free world. The real risk-free rate is not static-it changes over time, depending on economic conditions, especially (1) the rate of return that corporations and other borrowers exoect to earn on productive assets and (2) people's time preferences for current versus future consumption. IP= Inflation premium. IP is equal to the average expected rate of inflation over the life of the security. The expected future inflation rate is not necessarlly equal to the current inflation rate, so IP is not necessarily equal to current inflation. raF=r+LP. It is the quoted rate on a risk-free security such as a U.S. Treasury bill, which is very liquid and is free of most types of risk. Note that the premlum for expected inflation, IP, is included in rRF. DPR= default risk premium. This premium reflects the possibility that the issuer will not pay the promised interest or principal at the stated time. DPR is zero for U.S. Treasury securities, but it rises as the riskiness of the issuer increases. LP= liquidity (or marketability) premium. This is a premium charged by lenders to reflect the fact that some secunties cannot be IP= inflation premium. IP is equal to the average expected rate of inflation over the life of the security. The expected future inflation rate is not necessarily equal to the current inflation rate, so IP is not necessarily equal to current inflation. rRF=r+LP. It is the quoted rate on a risk-free security such as a U.S. Treasury bill, which is very liquid and is free of most types of risk. Note that the premium for expected inflation, IP, is included in rRF. DPR = default risk premium. This premium reflects the possibility that the issuer will not pay the promised interest or principal at the stated time. DPR is zero for U.S. Treasury securities, but it rises as the riskiness of the issuer increases. LP = liquidity (or marketablity) premium. This is a premium charged by lenders to reflect the fact that some securities cannot be converted to cash on short notice at a "reasonable" price. LP is very low for Treasury securities and for securities issued by large, strong firms, but it is relatively high on securities issued by small, privately held firms. MRP = maturity risk premium, Longer-term bonds, including Treasury bonds, are exposed to a significant risk of price declines due to increases in inflation and interest rates, and a maturity risk premium is charged by lenders to reflect this risk. The prices of long-term bonds decline whenever interest rates rise, and because interest rates can and do occasionally rise, all long-term bonds, even Treasury bonds, have an element of risk called interest rate risk. The bonds of any organization have more interest rate risk the longer the maturity of the bond. Therefore, a maturity risk premium (MRP), which is higher the greater the years to maturity, is included in the required interest rate. For example, if you know that the real rate of interest is 4% and it is expected to remain constant for the next 3 years, inflation is expected to be 2.00% next year, 4.50% the following year, and 6.00% the third year, then the average expected inflation rate over the next three years is 3200%+450%+6005=4.17%. If also you can estimate that the maturity risk premium is 0.1(t1)%, where t is number of years to ntoturity, then the yield on a 1-year Treasury bill, which has neither default risk premium nor liquidity risk premium, is as follows: rT1=r+P1+MRP=4%+2.00%+0.1(11)%=6.00% mm=r+IP1+MRP1=4%+2.00%+0.1(11)%=6.00% Complete the following table by calculating yields on a 2- and 3-year Treasury bills, respectively. Unlike Treasury securities, corporate bonds have both a default risk premium and a liquidity risk premium. Suppose that the liquidity premium on 3 -year bonds is LP=0.25%, and the default risk premium on 3 -year bonds is DRP=1.70%. The formula for calculating the yield on a corporate bond is rcop=IP+LP+MRPrcorp=r+IP+DRP+LP+MRPrcorp=r+IP+LP+MRPrcorp=IP+DRP+LP+MRP The yield on a 3-year corporate bond is