Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you have $10,000 that you can use for retirement planning investment. Create a diversified portfolio so you are able to invest the funds

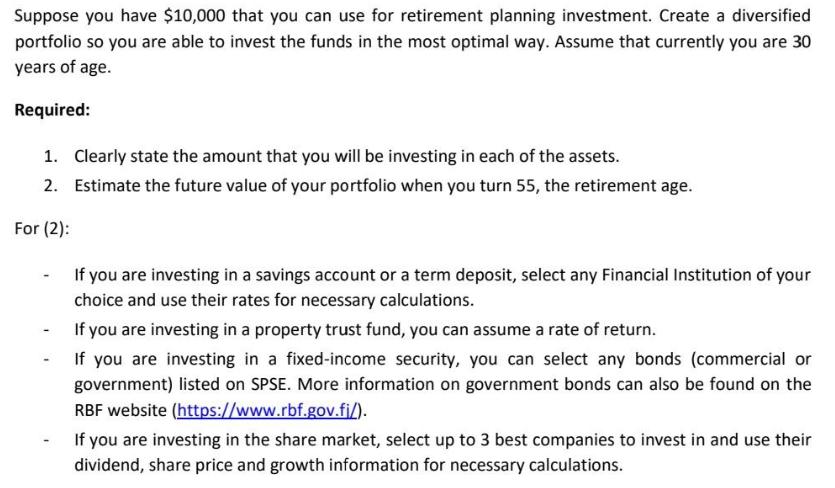

Suppose you have $10,000 that you can use for retirement planning investment. Create a diversified portfolio so you are able to invest the funds in the most optimal way. Assume that currently you are 30 years of age. Required: 1. Clearly state the amount that you will be investing in each of the assets. 2. Estimate the future value of your portfolio when you turn 55, the retirement age. For (2): If you are investing in a savings account or a term deposit, select any Financial Institution of your choice and use their rates for necessary calculations. If you are investing in a property trust fund, you can assume a rate of return. If you are investing in a fixed-income security, you can select any bonds (commercial or government) listed on SPSE. More information on government bonds can also be found on the RBF website (https://www.rbf.gov.fj/). If you are investing in the share market, select up to 3 best companies to invest in and use their dividend, share price and growth information for necessary calculations.

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Stages of retirement Young Adulthood 21 to 35 Early Middle age 36 50 Later Middle age 50 65 While st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started