Question

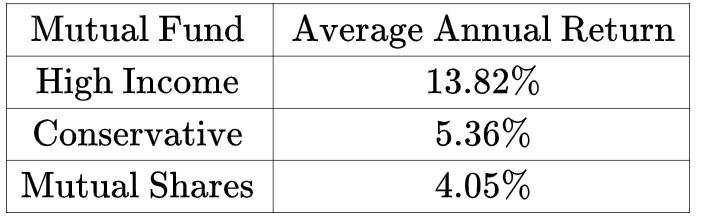

The average annual return over a certain 5 year period of 3 different mutual funds offered by Franklin Templeton is shown in the table below.

The average annual return over a certain 5 year period of 3 different mutual funds offered by Franklin Templeton is shown in the table below. Suppose you have $6000 to invest in these 3 funds. You will invest $200 more in the High Income fund than you will in the Conservative fund. How much should you invest for a year in each fund if you want your average annual return to be 7%? Set up 3 equations and use matrix algebra to find the solution.

I do not understand how to use the matrix algebra to solve the equations.

for my equations I got x+y+z= 6000, x-y=200, and 0.1382x +0.0536y + 0.04052z= 0.07(600). basically I don't know how to type this into my calculator.

Mutual Fund Average Annual Return High Income 13.82% Conservative 5.36% 4.05% Mutual Shares

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Let x y z be the amounts invested in High income conservative and Mutual shares Then the total am...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started