Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you have a portfolio of stocks and think the market will go down over the period of investment. You would like to hedge the

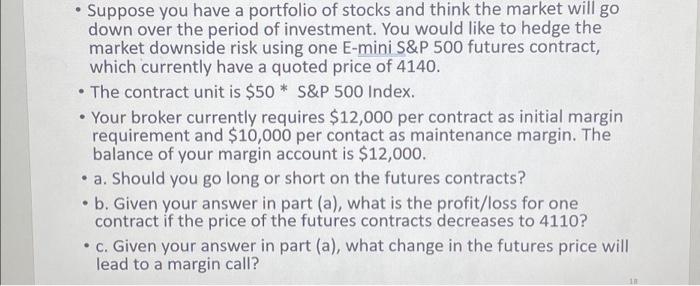

Suppose you have a portfolio of stocks and think the market will go down over the period of investment. You would like to hedge the market downside risk using one E-mini S&P 500 futures contract, which currently have a quoted price of 4140. The contract unit is $50 * S&P 500 Index. Your broker currently requires $12,000 per contract as initial margin requirement and $10,000 per contact as maintenance margin. The balance of your margin account is $12,000. a. Should you go long or short on the futures contracts? b. Given your answer in part (a), what is the profit/loss for one contract if the price of the futures contracts decreases to 4110? c. Given your answer in part (a), what change in the futures price will lead to a margin call? 18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started