Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you have an emerging business that needs financial assistance, and you need to make a proposal for funding to potential investors Create a

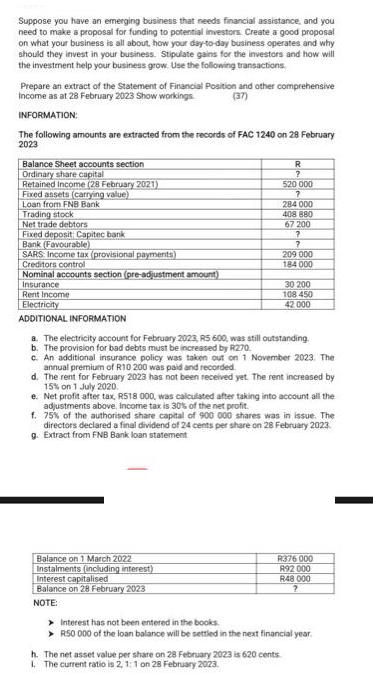

Suppose you have an emerging business that needs financial assistance, and you need to make a proposal for funding to potential investors Create a good proposal on what your business is all about how your day-to-day business operates and why should they invest in your business. Stipulate gains for the investors and how will the investment help your business grow. Use the following transactions. Prepare an extract of the Statement of Financial Position and other comprehensive Income as at 28 February 2023 Show workings (37) INFORMATION: The following amounts are extracted from the records of FAC 1240 on 28 February 2023 Balance Sheet accounts section Ordinary share capital Retained Income (28 February 2021) Fixed assets (carrying value) Loan from FNB Bank Trading stock Net trade debtors Fixed deposit Capitec bank Bank (Favourable) SARS Income tax (provisional payments) Creditors control Nominal accounts section (pre-adjustment amount) Insurance Rent Income Electricity ADDITIONAL INFORMATION R ? 520 000 ? Balance on 1 March 2022 Instalments (including interest) 284 000 408 880 67 200 Interest capitalised Balance on 28 February 2023 NOTE: ? ? a. The electricity account for February 2023, RS 600, was still outstanding. b. The provision for bad debts must be increased by R270. 209 000 184 000 c. An additional insurance policy was taken out on 1 November 2023. The annual premium of R10 200 was paid and recorded 30 200 108 450 42 000 d. The rent for February 2023 has not been received yet. The rent increased by 15% on 1 July 2020. h. The net asset value per share on 28 February 2023 is 620 cents 1. The current ratio is 2, 1:1 on 28 February 2023. e. Net profit after tax, R518 000, was calculated after taking into account all the adjustments above, Income tax is 30% of the net profit. f. 75% of the authorised share capital of 900 000 shares was in issue. The directors declared a final dividend of 24 cents per share on 28 February 2023. g. Extract from FNB Bank loan statement R376 000 R92 000 R48 000 ? Interest has not been entered in the books. R50 000 of the loan balance will be settled in the next financial year

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Your Name Your TitlePosition Your Company Name Date Investors Name Investors TitlePosition Investors Company Name Address Dear Investors Name Subject Investment Opportunity in Your Business Name I hop...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started