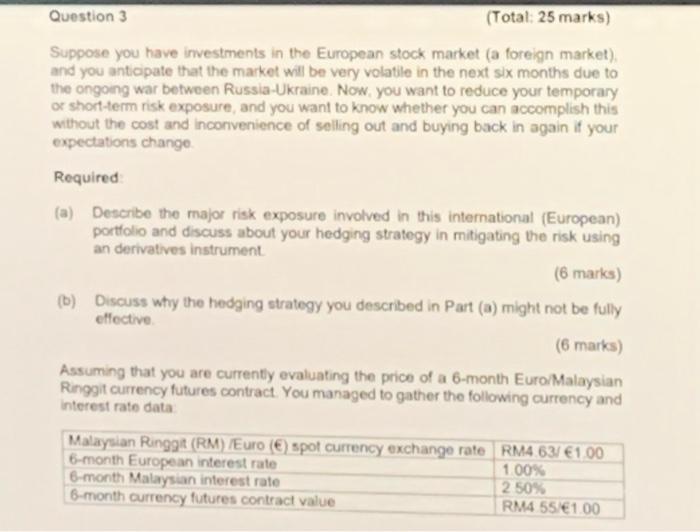

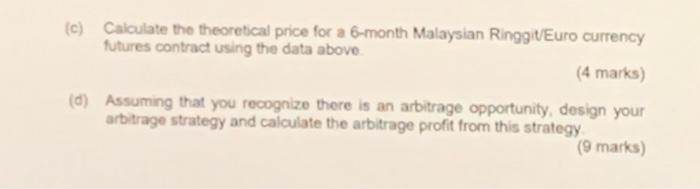

Suppose you have investments in the European stock market (a foreign market). and you anticipate that the market will be very volatile in the next six months due to the ongong war between Russia-Ukraine. Now, you want to reduce your temporary or short-term risk exposure, and you want to know whether you can accomplish this without the cost and incorvenience of selling out and buying back in again if your expectations change Required (a) Describe the major risk exposure involved in this intemational (European) portfolio and discuss about your hedging strategy in mitigating the risk using an derivatives instrument. (6 marks) (b) Discuss why the hedging strategy you described in Part (a) might not be fully effective. (6 marks) Assuming that you are currently evaluating the price of a 6-month Euro/Malaysian Ringgit currency futures contract. You managed to gather the following currency and interest rate data (c) Calculate the theoretical price for a 6-month Malaysian Ringgiv/Euro currency. futures contract using the data above (4 marks) (d) Assuming that you recognize there is an arbitrage opportunity, design your arbitrage strategy and calculate the arbitrage profit from this strategy. (9 marks) Suppose you have investments in the European stock market (a foreign market). and you anticipate that the market will be very volatile in the next six months due to the ongong war between Russia-Ukraine. Now, you want to reduce your temporary or short-term risk exposure, and you want to know whether you can accomplish this without the cost and incorvenience of selling out and buying back in again if your expectations change Required (a) Describe the major risk exposure involved in this intemational (European) portfolio and discuss about your hedging strategy in mitigating the risk using an derivatives instrument. (6 marks) (b) Discuss why the hedging strategy you described in Part (a) might not be fully effective. (6 marks) Assuming that you are currently evaluating the price of a 6-month Euro/Malaysian Ringgit currency futures contract. You managed to gather the following currency and interest rate data (c) Calculate the theoretical price for a 6-month Malaysian Ringgiv/Euro currency. futures contract using the data above (4 marks) (d) Assuming that you recognize there is an arbitrage opportunity, design your arbitrage strategy and calculate the arbitrage profit from this strategy. (9 marks)