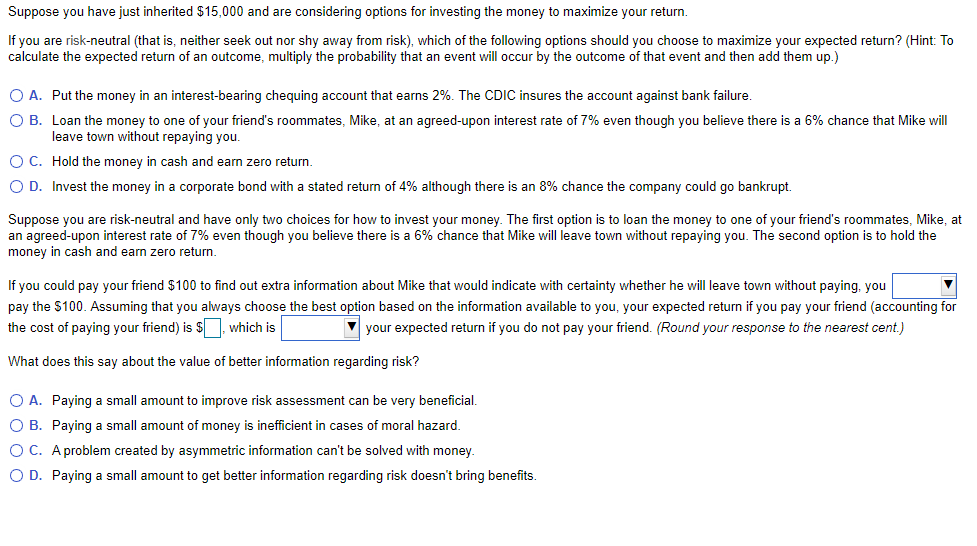

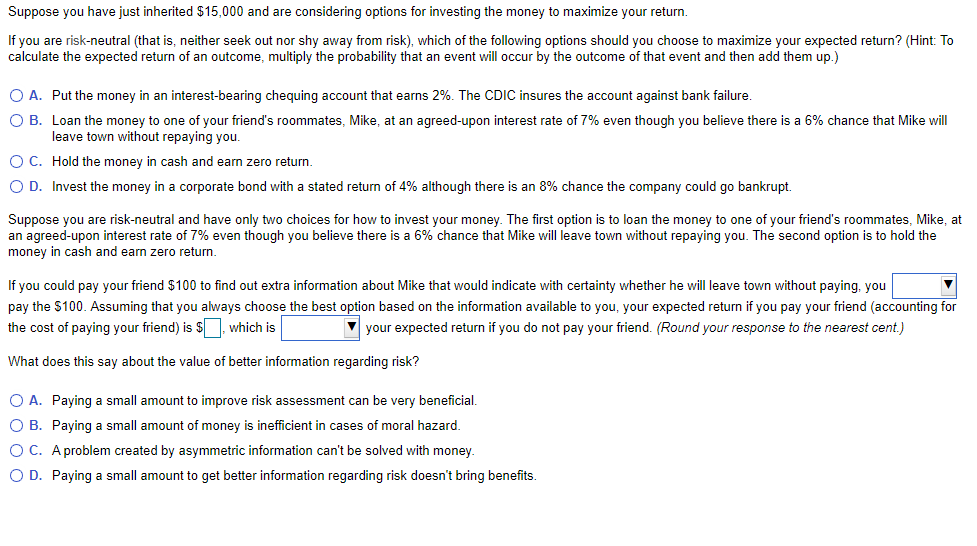

Suppose you have just inherited $15,000 and are considering options for investing the money to maximize your return. If you are risk-neutral (that is, neither seek out nor shy away from risk), which of the following options should you choose to maximize your expected return? (Hint: To calculate the expected return of an outcome, multiply the probability that an event will occur by the outcome of that event and then add them up.) O A. Put the money in an interest-bearing chequing account that earns 2%. The CDIC insures the account against bank failure. O B. Loan the money to one of your friend's roommates, Mike, at an agreed-upon interest rate of 7% even though you believe there is a 6% chance that Mike will leave town without repaying you. O C. Hold the money in cash and earn zero return. OD. Invest the money in a corporate bond with a stated return of 4% although there is an 8% chance the company could go bankrupt. Suppose you are risk-neutral and have only two choices for how to invest your money. The first option is to loan the money to one of your friend's roommates, Mike, at an agreed-upon interest rate of 7% even though you believe there is a 6% chance that Mike will leave town without repaying you. The second option is to hold the money in cash and earn zero return. If you could pay your friend $100 to find out extra information about Mike that would indicate with certainty whether he will leave town without paying, you pay the $100. Assuming that you always choose the best option based on the information available to you, your expected return if you pay your friend (accounting for the cost of paying your friend) is $, which is your expected return if you do not pay your friend. (Round your response to the nearest cent.) What does this say about the value of better information regarding risk? O A. Paying a small amount to improve risk assessment can be very beneficial. O B. Paying a small amount of money inefficient in cases of moral hazard. O C. A problem created by asymmetric information can't be solved with money OD. Paying a small amount to get better information regarding risk doesn't bring benefits