Answered step by step

Verified Expert Solution

Question

1 Approved Answer

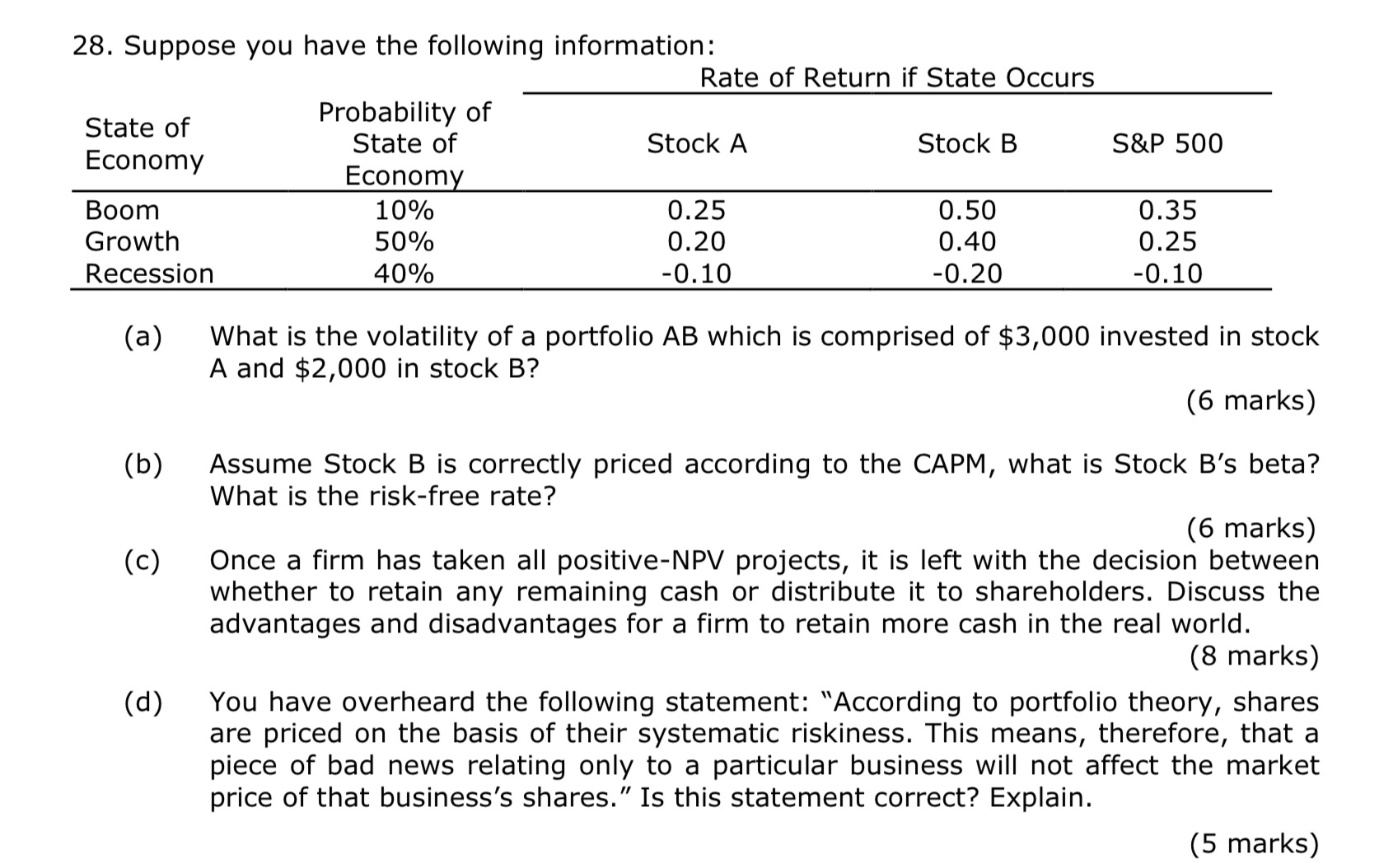

Suppose you have the following information: ( a ) What is the volatility of a portfolio A B which is comprised of $ 3 ,

Suppose you have the following information:

a What is the volatility of a portfolio which is comprised of $ invested in stock

A and $ in stock

marks

b Assume Stock B is correctly priced according to the CAPM, what is Stock Bs beta?

What is the riskfree rate?

marks

c Once a firm has taken all positiveNPV projects, it is left with the decision between

whether to retain any remaining cash or distribute it to shareholders. Discuss the

advantages and disadvantages for a firm to retain more cash in the real world.

marks

d You have overheard the following statement: "According to portfolio theory, shares

are priced on the basis of their systematic riskiness. This means, therefore, that a

piece of bad news relating only to a particular business will not affect the market

price of that business's shares." Is this statement correct? Explain.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started