Answered step by step

Verified Expert Solution

Question

1 Approved Answer

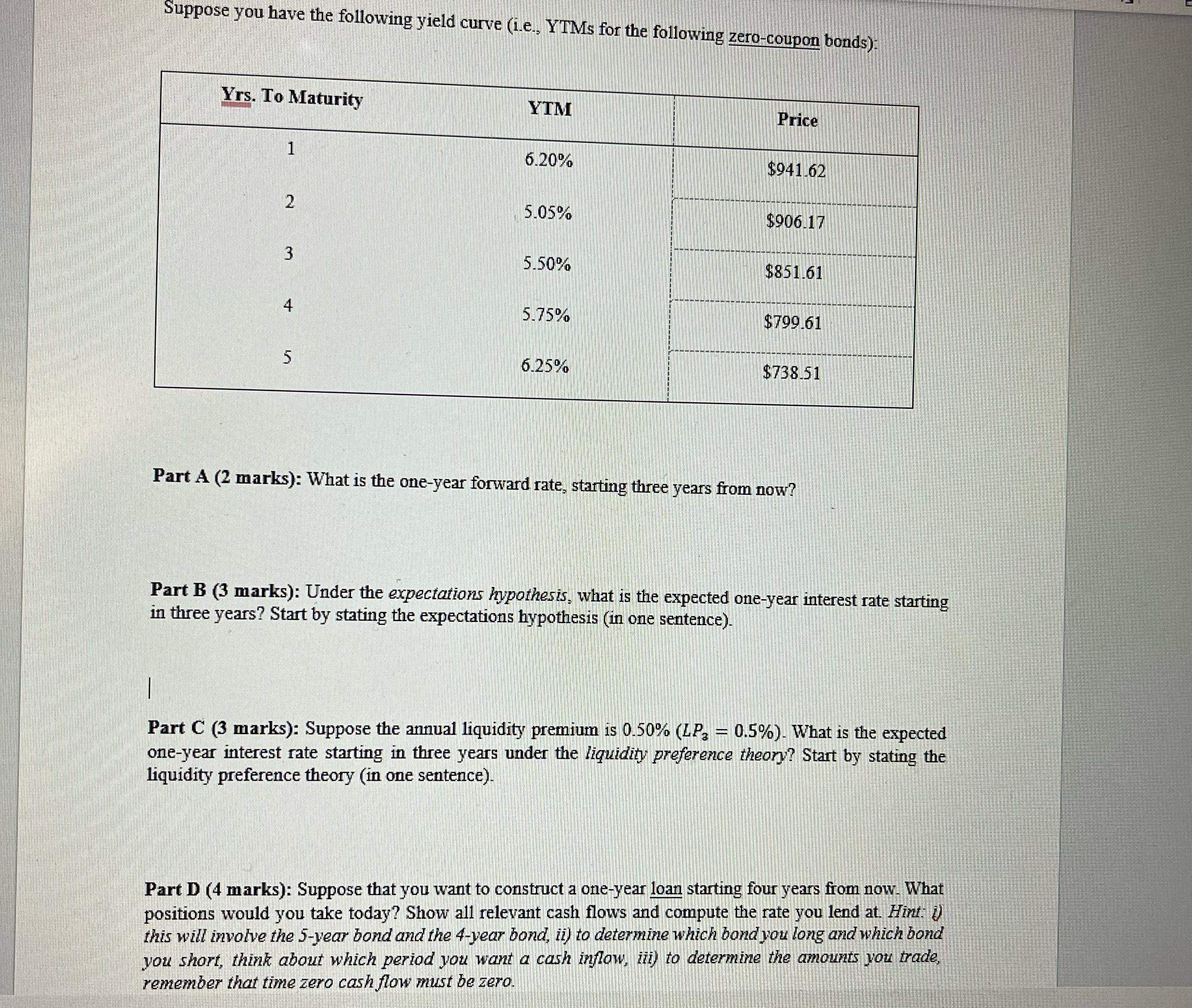

Suppose you have the following yield curve (i.e., YTMs for the following zero-coupon bonds): Yrs. To Maturity 1 2 3 4 5 YTM 6.20%

Suppose you have the following yield curve (i.e., YTMs for the following zero-coupon bonds): Yrs. To Maturity 1 2 3 4 5 YTM 6.20% 5.05% 5.50% 5.75% 6.25% Price $941.62 $906.17 $851.61 $799.61 $738.51 Part A (2 marks): What is the one-year forward rate, starting three years from now? Part B (3 marks): Under the expectations hypothesis, what is the expected one-year interest rate starting in three years? Start by stating the expectations hypothesis (in one sentence). | Part C (3 marks): Suppose the annual liquidity premium is 0.50% (LP = 0.5%). What is the expected one-year interest rate starting in three years under the liquidity preference theory? Start by stating the liquidity preference theory (in one sentence). Part D (4 marks): Suppose that you want to construct a one-year loan starting four years from now. What positions would you take today? Show all relevant cash flows and compute the rate you lend at. Hint: i) this will involve the 5-year bond and the 4-year bond, ii) to determine which bond you long and which bond you short, think about which period you want a cash inflow, iii) to determine the amounts you trade, remember th time zero cash flow must be zero.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Part A The oneyear forward rate starting three years from now can be calculated using the formula Forward Rate 1 YTMnn 1 YTMn1n1 1 where YTMn is the y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started