Answered step by step

Verified Expert Solution

Question

1 Approved Answer

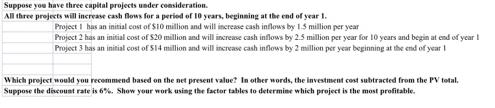

Suppose you have three capital projects under consideration. All three projects will increase cash flows for a period of 10 years, beginning at the

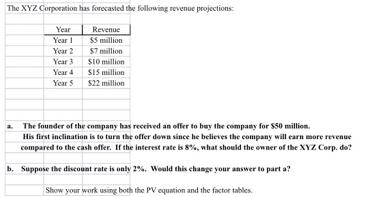

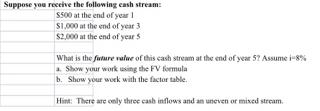

Suppose you have three capital projects under consideration. All three projects will increase cash flows for a period of 10 years, beginning at the end of year 1. Project I has an initial cost of $10 million and will increase cash inflows by 1.5 million per year Project 2 has an initial cost of $20 million and will increase cash inflows by 2.5 million per year for 10 years and begin at end of year I Project 3 has an initial cost of 514 million and will increase cash inflows by 2 million per year beginning at the end of year 1 Which project would you recommend based on the net present value? In other words, the investment cost subtracted from the PV total, Suppose the discount rate is 6%. Show your work using the factor tables to determine which project is the most profitable. The XYZ Corporation has forecasted the following revenue projections: Revenue $5 million $7 million $10 million $15 million $22 million Year Year 1 Year 2 Year 3 Year 4 Year 5 a. The founder of the company has received an offer to buy the company for $50 million. His first inclination is to turn the offer down since he believes the company will earn more revenue compared to the cash offer. If the interest rate is 8%, what should the owner of the XYZ Corp. do? b. Suppose the discount rate is only 2%. Would this change your answer to part a? Show your work using both the PV equation and the factor tables. Suppose you receive the following cash stream: $500 at the end of year 1 $1,000 at the end of year 3 $2,000 at the end of year 5 What is the future value of this cash stream at the end of year 5? Assume i-8% a. Show your work using the FV formula b. Show your work with the factor table. Hint: There are only three cash inflows and an uneven or mixed stream. Suppose you have three capital projects under consideration. All three projects will increase cash flows for a period of 10 years, beginning at the end of year 1. Project I has an initial cost of $10 million and will increase cash inflows by 1.5 million per year Project 2 has an initial cost of $20 million and will increase cash inflows by 2.5 million per year for 10 years and begin at end of year I Project 3 has an initial cost of 514 million and will increase cash inflows by 2 million per year beginning at the end of year 1 Which project would you recommend based on the net present value? In other words, the investment cost subtracted from the PV total, Suppose the discount rate is 6%. Show your work using the factor tables to determine which project is the most profitable. The XYZ Corporation has forecasted the following revenue projections: Revenue $5 million $7 million $10 million $15 million $22 million Year Year 1 Year 2 Year 3 Year 4 Year 5 a. The founder of the company has received an offer to buy the company for $50 million. His first inclination is to turn the offer down since he believes the company will earn more revenue compared to the cash offer. If the interest rate is 8%, what should the owner of the XYZ Corp. do? b. Suppose the discount rate is only 2%. Would this change your answer to part a? Show your work using both the PV equation and the factor tables. Suppose you receive the following cash stream: $500 at the end of year 1 $1,000 at the end of year 3 $2,000 at the end of year 5 What is the future value of this cash stream at the end of year 5? Assume i-8% a. Show your work using the FV formula b. Show your work with the factor table. Hint: There are only three cash inflows and an uneven or mixed stream.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this multipart question Part 1 Evaluate the three projects based on net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started