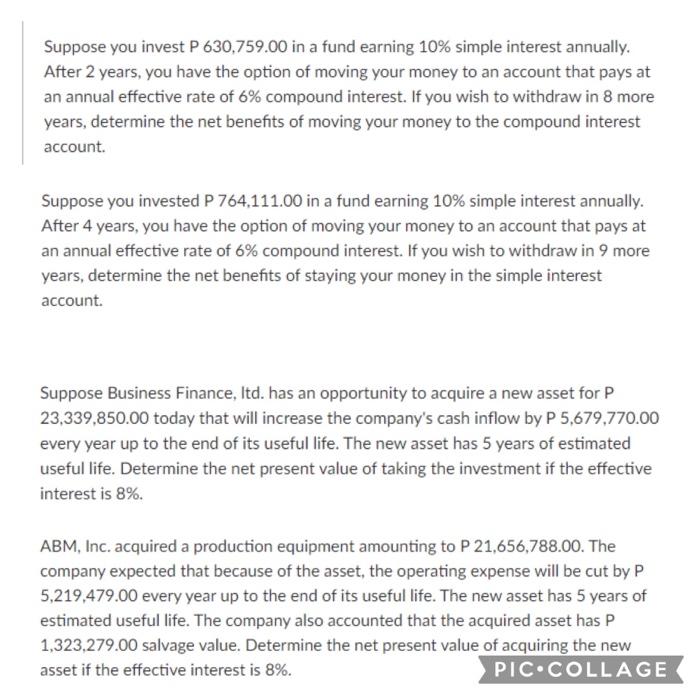

Suppose you invest P 630,759.00 in a fund earning 10% simple interest annually. After 2 years, you have the option of moving your money to an account that pays at an annual effective rate of 6% compound interest. If you wish to withdraw in 8 more years, determine the net benefits of moving your money to the compound interest account. Suppose you invested P 764,111.00 in a fund earning 10% simple interest annually. After 4 years, you have the option of moving your money to an account that pays at an annual effective rate of 6% compound interest. If you wish to withdraw in 9 more years, determine the net benefits of staying your money in the simple interest account. Suppose Business Finance, Itd. has an opportunity to acquire a new asset for p 23,339,850.00 today that will increase the company's cash inflow by P 5,679,770.00 every year up to the end of its useful life. The new asset has 5 years of estimated useful life. Determine the net present value of taking the investment if the effective interest is 8%. ABM, Inc. acquired a production equipment amounting to P 21,656,788.00. The company expected that because of the asset, the operating expense will be cut by P 5,219,479.00 every year up to the end of its useful life. The new asset has 5 years of estimated useful life. The company also accounted that the acquired asset has P 1,323,279.00 salvage value. Determine the net present value of acquiring the new asset if the effective interest is 8%. PIC.COLLAGE Suppose you invest P 630,759.00 in a fund earning 10% simple interest annually. After 2 years, you have the option of moving your money to an account that pays at an annual effective rate of 6% compound interest. If you wish to withdraw in 8 more years, determine the net benefits of moving your money to the compound interest account. Suppose you invested P 764,111.00 in a fund earning 10% simple interest annually. After 4 years, you have the option of moving your money to an account that pays at an annual effective rate of 6% compound interest. If you wish to withdraw in 9 more years, determine the net benefits of staying your money in the simple interest account. Suppose Business Finance, Itd. has an opportunity to acquire a new asset for p 23,339,850.00 today that will increase the company's cash inflow by P 5,679,770.00 every year up to the end of its useful life. The new asset has 5 years of estimated useful life. Determine the net present value of taking the investment if the effective interest is 8%. ABM, Inc. acquired a production equipment amounting to P 21,656,788.00. The company expected that because of the asset, the operating expense will be cut by P 5,219,479.00 every year up to the end of its useful life. The new asset has 5 years of estimated useful life. The company also accounted that the acquired asset has P 1,323,279.00 salvage value. Determine the net present value of acquiring the new asset if the effective interest is 8%. PIC.COLLAGE