Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you long a 90-day LIBOR based FRA with notional amount of $10 million. The forward rate is 5.62 percent. At the FRA expiration, LIBOR

Suppose you long a 90-day LIBOR based FRA with notional amount of $10 million. The forward rate is 5.62 percent. At the FRA expiration, LIBOR is 6.05 percent. What is the dollar profit (or loss) on this FRA?

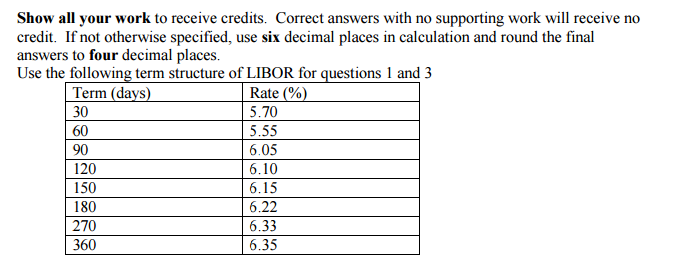

Show all your work to receive credits. Correct answers with no supporting work will receive no credit. If not otherwise specified, use six decimal places in calculation and round the final answers to four decimal places. Use the following term structure of LIBOR for questions 1 and 3 Term (days) Rate 5.70 30 60 5.55 90 605 120 6.10 150 6.15 180 6.22 270 6.33 360 6.35Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started