Question

Suppose you long one Australian dollar call and one Australian dollar put with an exercise exchange rate of 0.70 (USD/AUD) and 0.60 (USD/AUD) respectively. The

(a) Compute the net call payoff, net put payoff and net combined payoff.

(b) Plot separately the Net Long call payoff, the net long put payoff and the net combined payoff.

(c) Name and provide definition of the shape of the combined payoff obtained from part (b)?

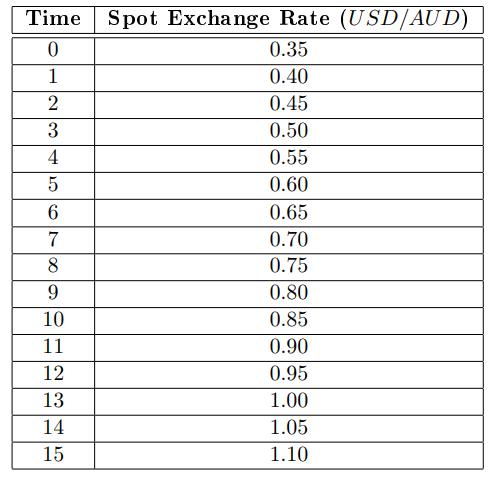

Time Spot Exchange Rate (USD/AUD) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 0.35 0.40 0.45 0.50 0.55 0.60 0.65 0.70 0.75 0.80 0.85 0.90 0.95 1.00 1.05 1.10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the net call payoff net put payoff and net combined payoff we need to determine the spot exchange rate in relation to the exercise exchange ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Corporate Finance

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

5th Edition

0135811600, 978-0135811603

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App