Question

Suppose you need to decide whether to keep a machine or replace it with a new one: Old machine: Old machine can operate for 5

Suppose you need to decide whether to keep a machine or replace it with a new one:

Old machine: Old machine can operate for 5 years with operating cost of $120,000 per year.

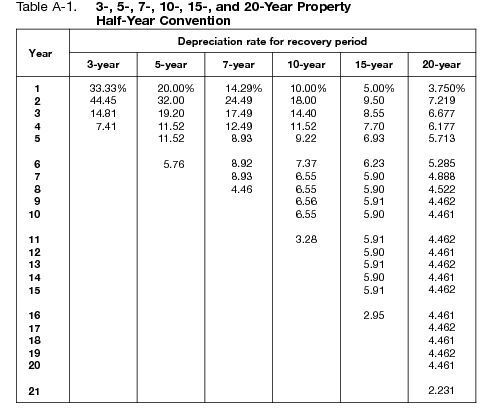

New machine: Replacing old machine with new one requires capital cost of $250,000 in year zero (zero salvage value for old machine). Capital cost is depreciable from year 0 to year 5 (over six years) based on MACRS 5-year life depreciation with the half year convention (table A-1 at IRS (Links to an external site.)). New machine can produce with lower operating cost of $45,000 per year for 5 years (from year 1 to year 5).

Assume both machines produce similar good with similar value that yields similar revenue.

Consider income tax of 38% and minimum rate of return 16%. Construct incremental analysis and conclude which alternative is more economically satisfactory? Please show your work.

ANSWER ON EXCEL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started