Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you observe the following information at the FINRA website regarding bonds issued by Advanced Micro Devices. a. What is the yield to maturity of

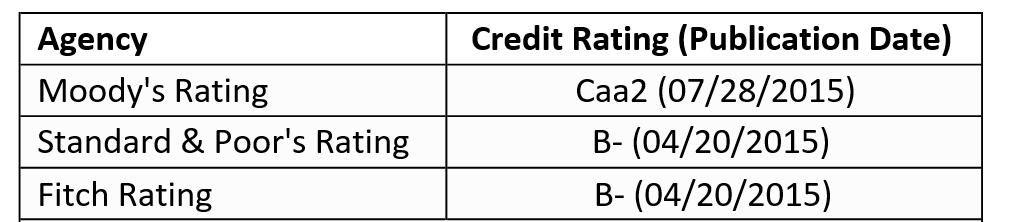

Suppose you observe the following information at the FINRA website regarding bonds issued by Advanced Micro Devices.

a. What is the yield to maturity of this bond as of 08/25/2015? b. What are the risk factors the yield you determined in part a offers rewards based on the information above? Explain. c. On 8/17/2018, the price (last trade price) of this bond was $106.00. What kind of a change in factor(s) you identified in part b would lead to the price on 8/17/2018? Which factor may be the most significant? Explain.

ADVANCED MICRO DEVICES INC Coupon Maturity Symbol Rate Date CUSIP Next Call Date Callable 7 % 7/1/2024 AMD4155878 007903BCO Yes Last Trade Price Last Trade Yield 7/1/2019 Last Trade Date US Treasury Yield $63.50 8/25/2015 - Agency Moody's Rating Standard & Poor's Rating Fitch Rating Credit Rating (Publication Date) Caa2 (07/28/2015) B- (04/20/2015) B- (04/20/2015) ADVANCED MICRO DEVICES INC Coupon Maturity Symbol Rate Date CUSIP Next Call Date Callable 7 % 7/1/2024 AMD4155878 007903BCO Yes Last Trade Price Last Trade Yield 7/1/2019 Last Trade Date US Treasury Yield $63.50 8/25/2015 - Agency Moody's Rating Standard & Poor's Rating Fitch Rating Credit Rating (Publication Date) Caa2 (07/28/2015) B- (04/20/2015) B- (04/20/2015)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started