Question

Suppose you own 88,000 shares of common stock in a firm with 4.4 million total shares outstanding. The firm announces a plan to sell an

Suppose you own 88,000 shares of common stock in a firm with 4.4 million total shares outstanding. The firm announces a plan to sell an additional 2.2 million shares through a rights offering. The market value of the stock is $40 before the rights offering and the new shares are being offered to existing shareholders at a $5 discount.

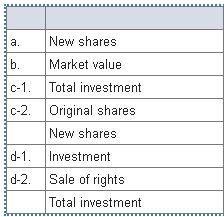

a. If you exercise your preemptive rights, how many of the new shares can you purchase?

b. What is the market value of the stock after the rights offering? (Enter your answer in millions rounded to 1 decimal place. (e.g., 32.1))

c-1. What is your total investment in the firm after the rights offering? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. (e.g., 32.16))

c-2. If you exercise your preemptive right how many original shares and how many new shares do you have?

d-1. If you decide not to exercise your preemptive rights, what is your investment in the firm after the rights offering? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places. (e.g., 32.161))

d-2. If you sell your rights rather than use them, how much money will you receive from the rights sale and what is the total value of your proceeds from the sale of the rights offering plus your investment in the firm? (Enter your answer in millions rounded to 3 decimal places. (e.g., 32.161))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started