Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you plan to invest in Nestle for only one year. You are considering hedging your currency risk. q , Hedge with an option because

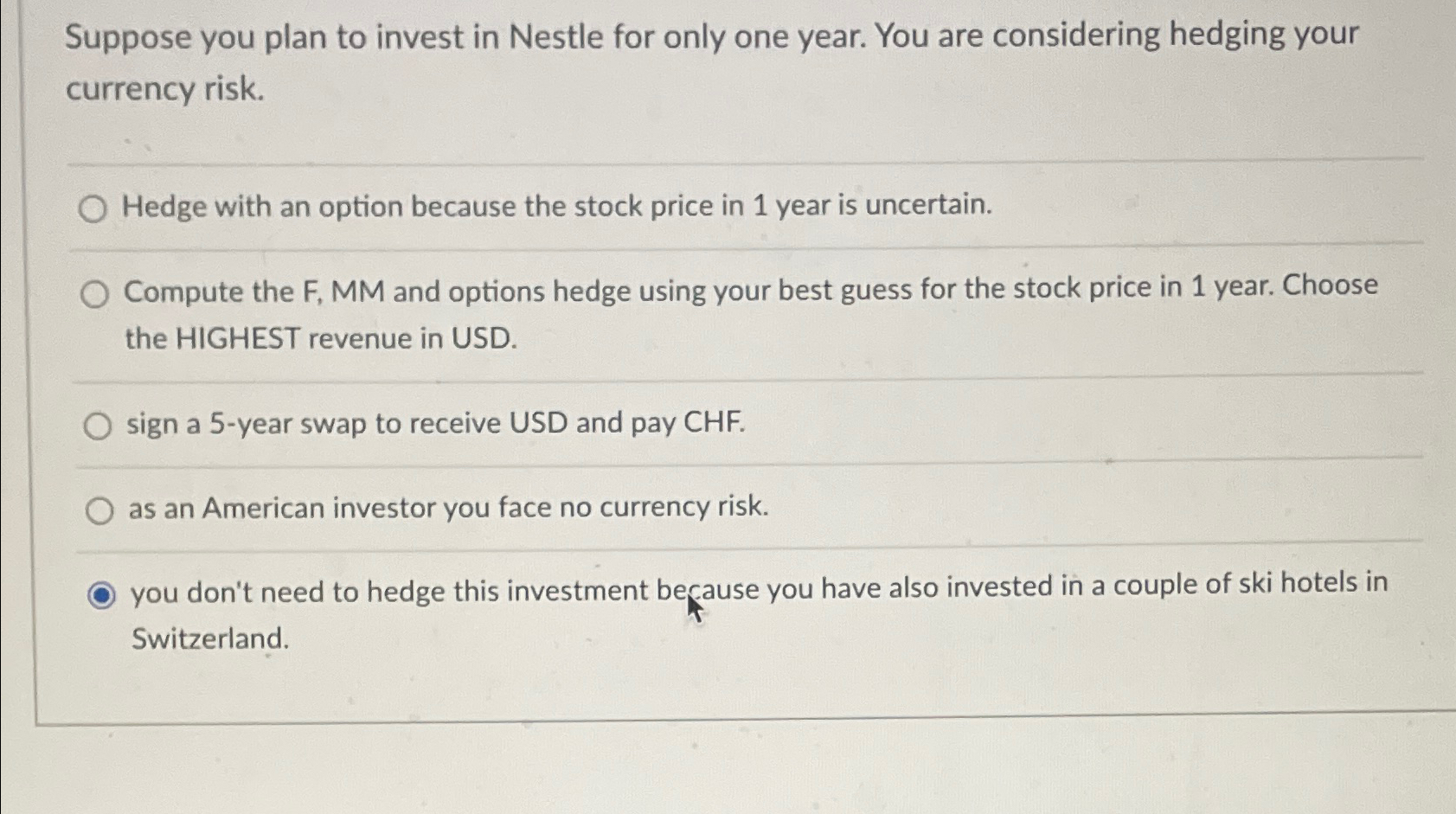

Suppose you plan to invest in Nestle for only one year. You are considering hedging your currency risk. Hedge with an option because the stock price in year is uncertain. Compute the F MM and options hedge using your best guess for the stock price in year. Choose the HIGHEST revenue in USD. sign a year swap to receive USD and pay CHF as an American investor you face no currency risk. you don't need to hedge this investment be ause you have also invested in a couple of ski hotels in Switzerland.

Suppose you plan to invest in Nestle for only one year. You are considering hedging your currency risk.

Hedge with an option because the stock price in year is uncertain.

Compute the F MM and options hedge using your best guess for the stock price in year. Choose the HIGHEST revenue in USD.

sign a year swap to receive USD and pay CHF

as an American investor you face no currency risk.

you don't need to hedge this investment be ause you have also invested in a couple of ski hotels in Switzerland.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started