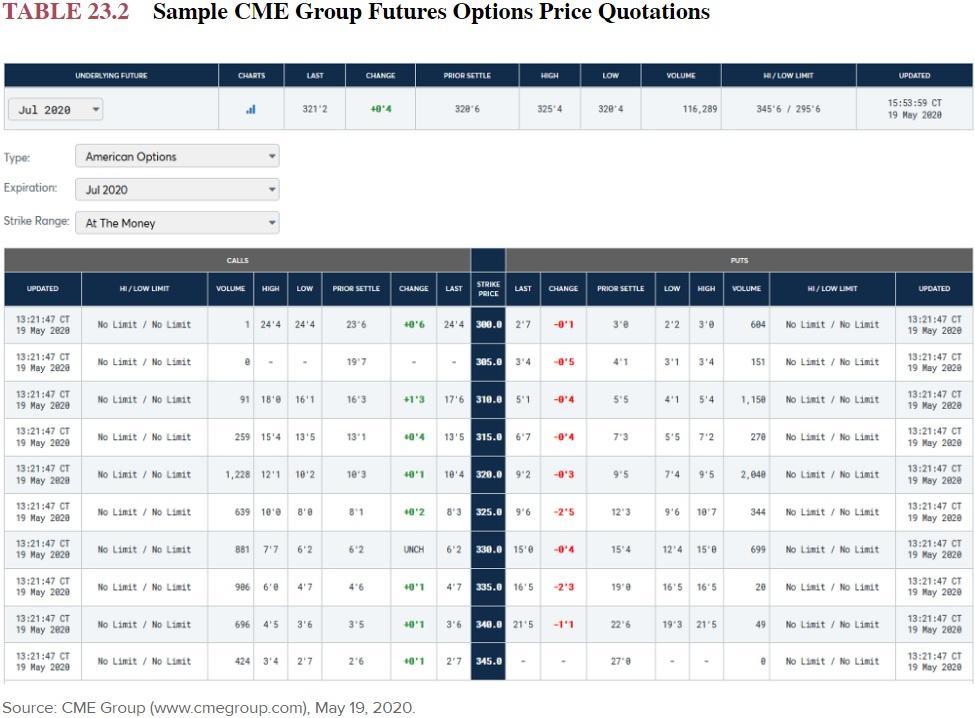

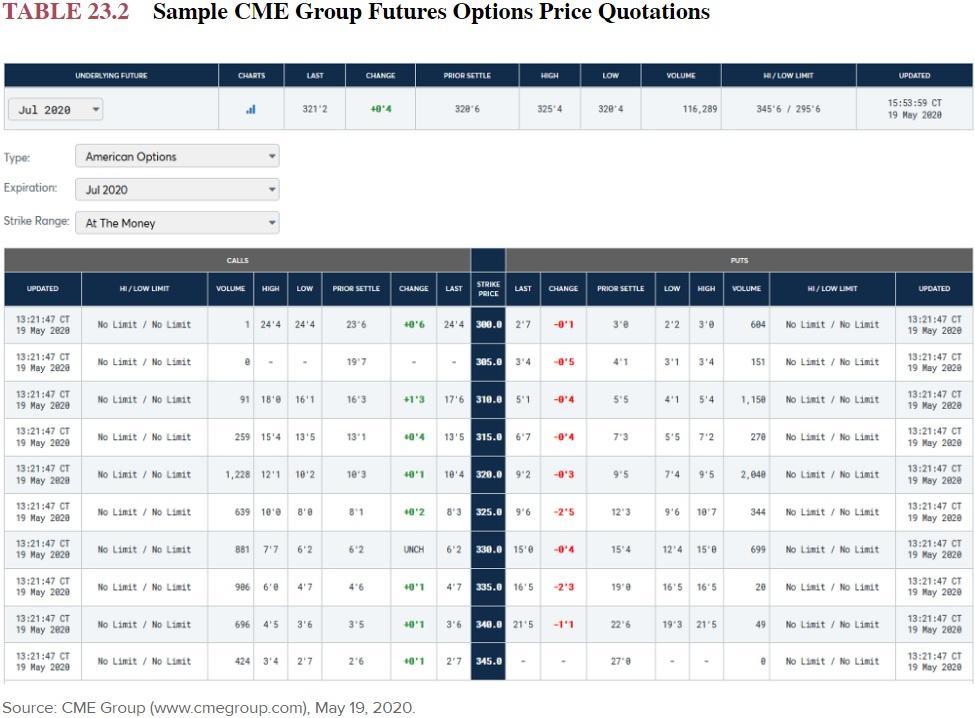

Suppose you purchase the July 2020 put option on corn futures with a strike price of $3.25. Assume your purchase was at the last price of the day. Use Table 23.2. a. How much does your option cost per bushel of corn? (Round your answer to 4 decimal places, e.g., 32.1616.) b. What is the total cost for one contract? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn futures is $3.08 per bushel at expiration of the option contract. Each contract is for 5,000 bushels. What is your net profit or loss from this position? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $3.32 per bushel at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Option cost per bushel b. Total cost C. d. TABLE 23.2 Sample CME Group Futures Options Price Quotations UNDERLYING FUTURE CHARTS LAST CHANGE PRIOR SETTLE HIGH LOW VOLUME /LOW LIMIT UPDATED Jul 2020 .. 3212 404 3286 325 4 3204 116,289 345'6 / 295'6 / 15:53:59 CT 19 May 2020 Type: American Options Expiration: Jul 2020 Strike Range At The Money CALLS PUTS UPDATED HI/LOW LIMIT VOLUME HIGH LOW PRIOR SETTLE CHANGE LAST STRIKE PRICE LAST CHANGE PRIOR SETTLE LOW HIGH VOLUME HI/LOW LMT UPDATED 13:21:47 CT 19 May 2020 No Limit / No Limit 7 1 24'4 244 236 10'6 24'4 300.0 27 -91 3'e 22 310 684 No Limit / No Limit 13:21:47 CT 19 May 2820 13:21:47 CT 19 May 2020 No Limit / No Limit 197 305.0 -05 4'1 31 314 151 No Limit / No Limit 13:21:47 CT 19 May 2820 13:21:47 CT 19 May 2020 No Limit / No Limit 91 180 16'1 163 +1'3 17'6 310.0 51 -04 55 4'1 5'4 1,150 No Limit / No Limit 13:21:47 CT 19 May 2820 13:21:47 CT 19 May 2020 No Limit / No Limit 259 154 13'5 13'1 04 13'5 315.0 6'7 -04 73 5'5 72 278 No Limit / No Limit 13:21:47 CT 19 May 2020 13:21:47 CT 19 May 2020 No Limit / No Limit 1,228 121 10'2 10'3 401 10:4 320.0 9'2 -03 995 74 9'5 2,840 No Limit / No Limit / 13:21:47 CT 19 May 2820 13:21:47 CT 19 May 2020 No Limit / No Limit 639 100 8' 81 02 8'3 325.0 9'6 -25 12'3 9'6 107 344 No Limit / No Limit / 13:21:47 CT 19 May 2020 13:21:47 CT 19 May 2020 No Limit / No Limit 881 6'2 62 UNCH 6'2 330.0 150 -04 154 124 15' 699 No Limit / No Limit 13:21:47 CT 19 May 2020 13:21:47 CT 19 May 2020 No Limit / No Limit 986 6'e 47 46 01 47 335.0 16'5 -23 1990 16'5 16'5 20 No Limit / No Limit / 13:21:47 CT 19 May 2020 13:21:47 CT 19 May 2020 No Limit / No Limit 696 4'5 36 3'5 01 3'6 340.0 21'5 -11 22'6 193 21'5 49 No Limit / No Limit 13:21:47 CT 19 May 2020 13:21:47 CT 19 May 2020 No Limit / No Limit 424 34 27 26 01 27 345.0 279 e No Limit / No Limit 13:21:47 CT 19 May 2020 Source: CME Group (www.cmegroup.com), May 19, 2020