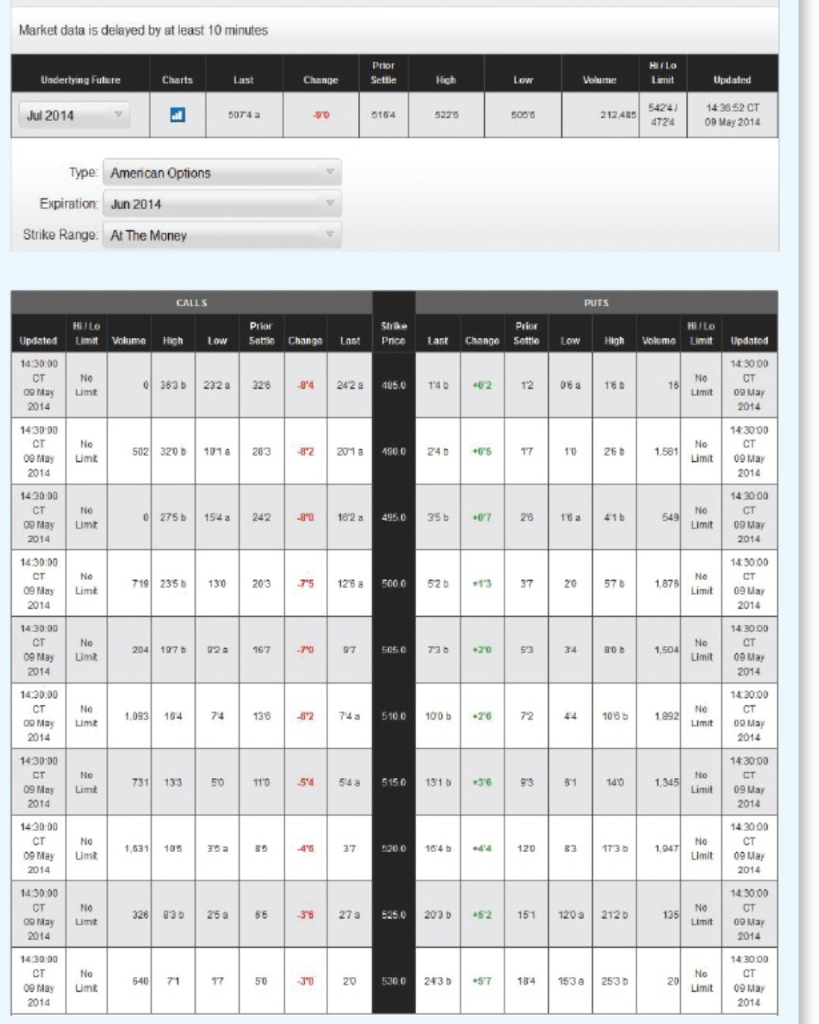

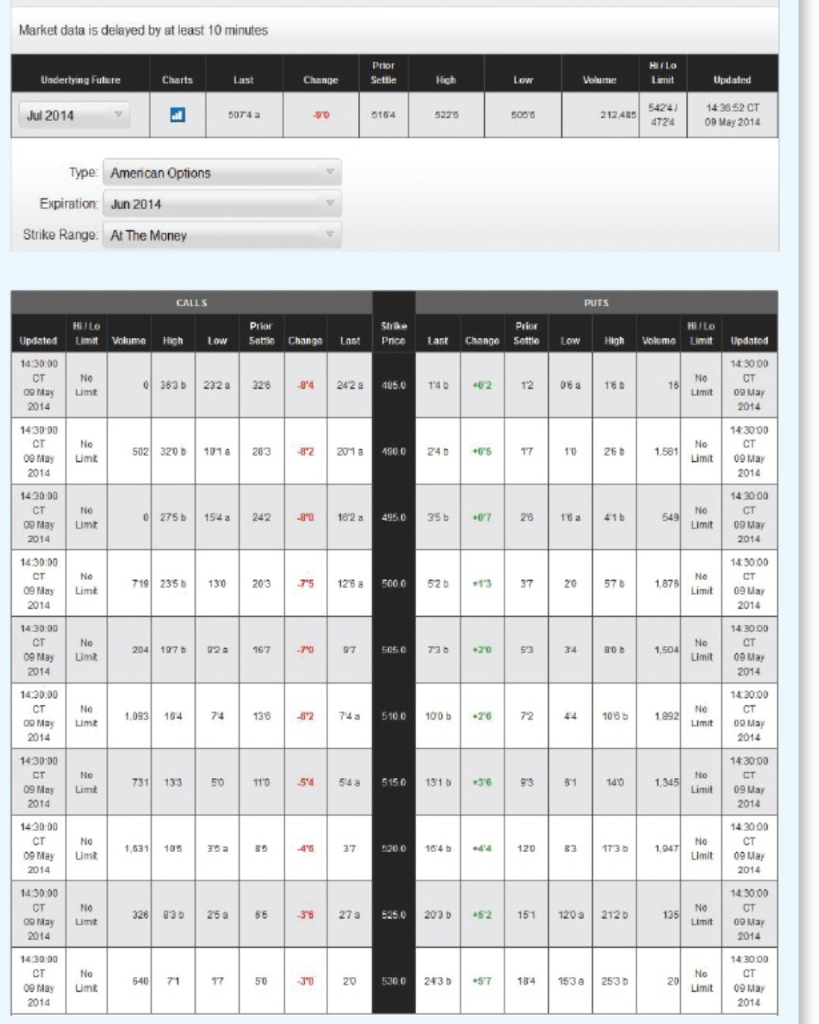

Suppose you purchase the June 2014 call option on corn futures with a strike price of $5.25 at the last price of the day. Use Table 23.2 How much does your option cost per bushel of corn? (Do not round intermediate calculations. Round your answer to 5 decimal places, e.g., 32.16161.) Option cost 2.7 per bushel What is the total cost of your position? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Total cost $ 1015 Suppose the price of corn is $5.17 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) Loss 435 What is your net profit or loss if corn futures prices are $5.38 per bushel at expiration? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) Profit 1015 Market data is delayed by at least 10 minutes HILO Undertying Future Charts Prior Settle Last Change High Low Volume Updated Jul 2014 5074 a -90 5154 5220 500 212485 5424) 4724 143852 CT On May 2014 Type: American Options Expiration: Jun 2014 Strike Range: At The Money CALLS PUTS Hilo Strike Price Prior Last Change Settle LOW High Volume Updated HIILO Prior Updated Umt Volume High Low Settle Change Lost 14:30:00 CT 383 2320 228 242 a 09 May Limit 2014 No 485.0 140 -02 12 06 a 160 18 No Limit 14.3000 CT 09 May 2014 1430:00 CT 00 May 2014 No Limt 502 320 D 1918 283 -32 2010 4500 240 's 17 10 260 1.581 No Limit 143000 CT 09 May 2014 1430:00 CT 09 May 2014 Ne Umt 0275 154 a 242 -8"0 162 a 4950 35 +07 28 18 a 549 No Limit 14 30.00 CT 09 May 2014 14:30:00 1430.00 CT 09 May 2014 Ne Limit 130 719 235 CT 203 -7'5 128 a 5000 13 52 37 20 57 1.875 No Limit 09 May 2014 14.3000 CT 09 May 2014 No No Umt 2041 107 02 167 -70 97 5050 20 34 53 1.504 14 30.00 CT 09 May 2014 14:30:00 CT 09 May 2014 Ne Limt 1,093 164 74 138 -392 74 a 5100 100 72 44 1085 1.992 No Limit 14:30:00 09 May 2014 143000 CT 14:30:00 Cr 09 May 2014 Ne Limit 731 133 50 110 -594 548 5150 131 93 81 140 1.345 No Limit 09 May 2014 1430:00 Cr 09 May 2014 No Umt 1,531 105 35 a 37 1200 1645 414 120 B3 1.947 NO Limit 14 3000 CT 09 May 2014 14:30:00 CT 09 May 2014 No Limt 326 930 25 a 3's 27a 525.0 2030 +52 151 120 a 2120 135 No Limit 14:30:00 CT 09 May 2014 143000 CT 09 May 2014 No Umt 14 300D CT 09 Ma 540 71 17 50 30 20 5300 243) 57 184 153 a 2530 No Limit 201 2014 Suppose you purchase the June 2014 call option on corn futures with a strike price of $5.25 at the last price of the day. Use Table 23.2 How much does your option cost per bushel of corn? (Do not round intermediate calculations. Round your answer to 5 decimal places, e.g., 32.16161.) Option cost 2.7 per bushel What is the total cost of your position? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Total cost $ 1015 Suppose the price of corn is $5.17 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) Loss 435 What is your net profit or loss if corn futures prices are $5.38 per bushel at expiration? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) Profit 1015 Market data is delayed by at least 10 minutes HILO Undertying Future Charts Prior Settle Last Change High Low Volume Updated Jul 2014 5074 a -90 5154 5220 500 212485 5424) 4724 143852 CT On May 2014 Type: American Options Expiration: Jun 2014 Strike Range: At The Money CALLS PUTS Hilo Strike Price Prior Last Change Settle LOW High Volume Updated HIILO Prior Updated Umt Volume High Low Settle Change Lost 14:30:00 CT 383 2320 228 242 a 09 May Limit 2014 No 485.0 140 -02 12 06 a 160 18 No Limit 14.3000 CT 09 May 2014 1430:00 CT 00 May 2014 No Limt 502 320 D 1918 283 -32 2010 4500 240 's 17 10 260 1.581 No Limit 143000 CT 09 May 2014 1430:00 CT 09 May 2014 Ne Umt 0275 154 a 242 -8"0 162 a 4950 35 +07 28 18 a 549 No Limit 14 30.00 CT 09 May 2014 14:30:00 1430.00 CT 09 May 2014 Ne Limit 130 719 235 CT 203 -7'5 128 a 5000 13 52 37 20 57 1.875 No Limit 09 May 2014 14.3000 CT 09 May 2014 No No Umt 2041 107 02 167 -70 97 5050 20 34 53 1.504 14 30.00 CT 09 May 2014 14:30:00 CT 09 May 2014 Ne Limt 1,093 164 74 138 -392 74 a 5100 100 72 44 1085 1.992 No Limit 14:30:00 09 May 2014 143000 CT 14:30:00 Cr 09 May 2014 Ne Limit 731 133 50 110 -594 548 5150 131 93 81 140 1.345 No Limit 09 May 2014 1430:00 Cr 09 May 2014 No Umt 1,531 105 35 a 37 1200 1645 414 120 B3 1.947 NO Limit 14 3000 CT 09 May 2014 14:30:00 CT 09 May 2014 No Limt 326 930 25 a 3's 27a 525.0 2030 +52 151 120 a 2120 135 No Limit 14:30:00 CT 09 May 2014 143000 CT 09 May 2014 No Umt 14 300D CT 09 Ma 540 71 17 50 30 20 5300 243) 57 184 153 a 2530 No Limit 201 2014