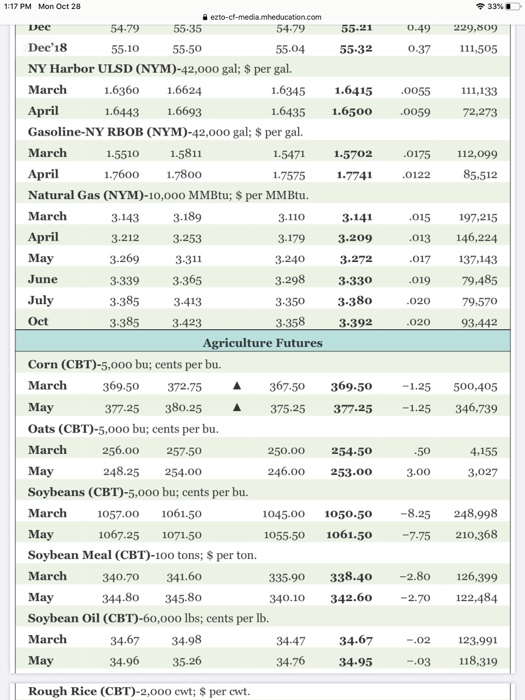

Suppose you purchase the May 2017 call option on corn futures with a strike price of $3.85. Assume you purchased the option at the last price if the day. Use Table 23.2 a. How much does your option cost per bushel of corn? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn futures is $3.74 per bushel at expiration of the option contract. Each contract is for 5,000 bushels. What is your net profit or loss from this position? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) d. What is your net profit or loss if corn futures prices are $4.13 per bushel at expiration? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) per bushel a. Option cost Total cost Profit Loss 33% 229,809 111,505 111,133 72,273 April 112,099 85,512 197,215 146,224 137,143 79,485 79.570 93,442 3-358 1:17 PM Mon Oct 28 erto-el-media.meducation.com Dee 54.79 55-35 54.79 55.21 0.49 Dee'18 55.10 5 5-50 55.04 55-32 0.37 NY Harbor ULSD (NYM)-42,000 gal; $ per gal. March 1.6360 1.6624 1.63451.6415 .0055 1.6443 1.6693 1.6435 1.6500 .0059 Gasoline-NY RBOB (NYM)-42,000 gal; $ per gal. March 1.5510 1.5811 1.5471 1.5702 .0175 April 1.7600 1.7800 1.7575 1.77410122 Natural Gas (NYM)-10,000 MMBtu; $ per MMBtu. March 3.143 3.189 3.110 3.141 .015 April 3.212 3.253 3.179 3.209 .013 May 3.269 3.311 3.240 3.272 .017 June 3-339 3.365 3.298 3-330 .019 July 3-385 3-413 3-350 3-380 .020 Oct 3-385 3423 3.392 .020 Agriculture Futures Corn (CBT)-5,000 bu; cents per bu. March 369.50 372.75 367.50 369.50 -1.25 May 377.25 380.25 A 375.25 377.25 -1.25 Oats (CBT)-5,000 bu; cents per bu. March 256.00 257.50 250.00 254.50 . .50 May 248.25 254.00 246.00 253.00 3.00 Soybeans (CBT)-5,000 bu; cents per bu. March 1057.00 1061.50 1045.00 1050.50 -8.25 May 1067.25 1071.50 1055-50 1061.50 -7.75 Soybean Meal (CBT)-100 tons; $ per ton. March 340.70 341.60 335.90 338.40 -2.80 May 344.80 345.80 340.10 342.60 -2.70 Soybean Oil (CBT)-60,000 lbs; cents per lb. March 34.67 34.98 34.47 34.67 -.02 May 34.96 35.26 34.76 34.95 -.03 500,405 346,739 4,155 3,027 248,998 210,368 126,399 122,484 123.991 118,319 Rough Rice (CBT)-2,000 cwt; $ per ewt