Answered step by step

Verified Expert Solution

Question

1 Approved Answer

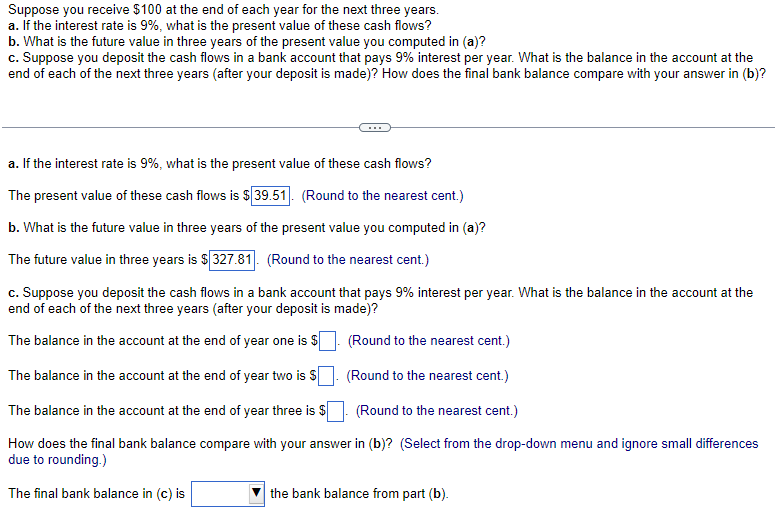

Suppose you receive $ 1 0 0 at the end of each year for the next three years. a . If the interest rate is

Suppose you receive $ at the end of each year for the next three years.

a If the interest rate is what is the present value of these cash flows?

b What is the future value in three years of the present value you computed in a

c Suppose you deposit the cash flows in a bank account that pays interest per year. What is the balance in the account at the

end of each of the next three years after your deposit is made How does the final bank balance compare with your answer in b

a If the interest rate is what is the present value of these cash flows?

The present value of these cash flows is

Round to the nearest cent.

b What is the future value in three years of the present value you computed in a

The future value in three years is $

Round to the nearest cent.

c Suppose you deposit the cash flows in a bank account that pays interest per year. What is the balance in the account at the

end of each of the next three years after your deposit is made

The balance in the account at the end of year one is $Round to the nearest cent.

The balance in the account at the end of year two is $Round to the nearest cent.

The balance in the account at the end of year three is $Round to the nearest cent.

How does the final bank balance compare with your answer in bSelect from the dropdown menu and ignore small differences

due to rounding.

The final bank balance in c is

the bank balance from part b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started