Answered step by step

Verified Expert Solution

Question

1 Approved Answer

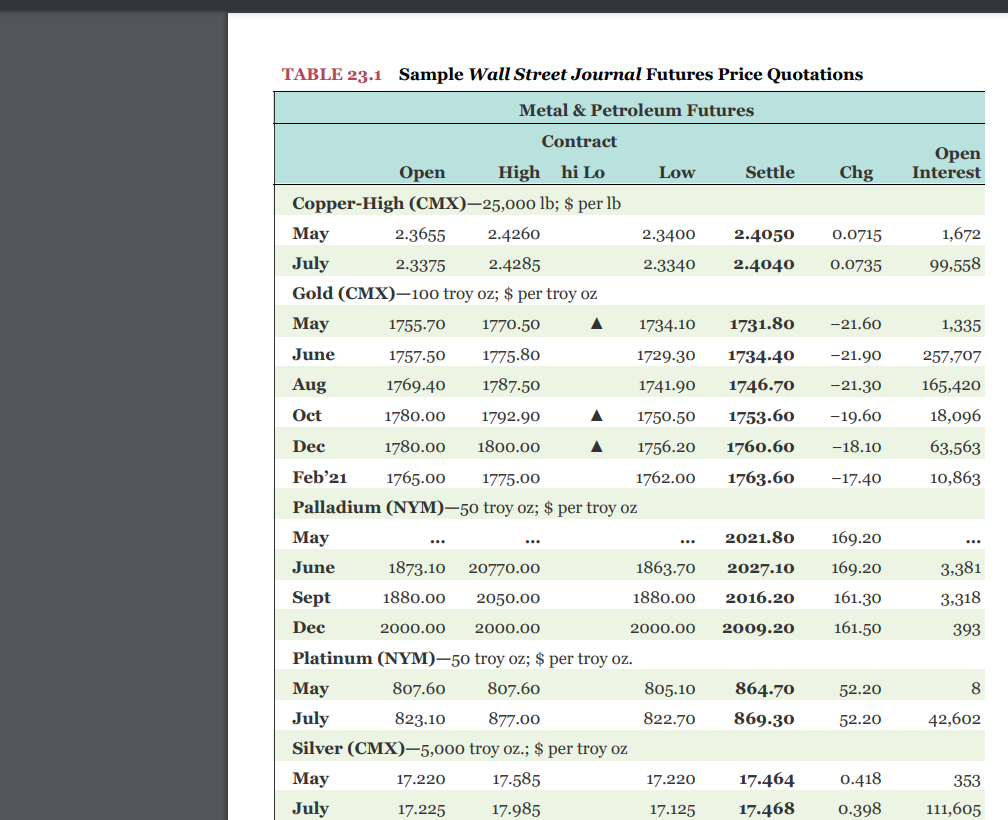

Suppose you sell nine December 2020 gold futures contracts this day at the last price of the day. Use Table 23.1. a. What will your

| Suppose you sell nine December 2020 gold futures contracts this day at the last price of the day. Use Table 23.1. |

| a. | What will your profit or loss be if gold prices turn out to be $1,793.20 per ounce at expiration? (Do not round intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, e.g., 32.16.) |

| b. | What will your profit or loss be if gold prices are $1,729.60 per ounce at expiration? (Do not round intermediate calculations and enter your answer as a positive value rounded to the nearest whole number, e.g., 32.) |

TABLE 23.1 Sample Wall Street Journal Futures Price Quotations \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|c|}{ Metal \& Petroleum Futures } \\ \hline \multicolumn{7}{|c|}{ Contract } & \multirow{2}{*}{\begin{tabular}{r} Open \\ Interest \\ \end{tabular}} \\ \hline & Open & High & hi Lo & Low & Settle & Chg & \\ \hline \multicolumn{8}{|c|}{ Copper-High (CMX)-25,0oo lb; \$ per lb } \\ \hline May & 2.3655 & 2.4260 & & 2.3400 & 2.4050 & 0.0715 & 1,672 \\ \hline July & 2.3375 & 2.4285 & & 2.3340 & 2.4040 & 0.0735 & 99,558 \\ \hline \multicolumn{8}{|c|}{ Gold (CMX)-10o troy oz; \$ per troy oz } \\ \hline May & 175570 & 1770.50 & & 1734.10 & 1731.80 & -21.60 & 1,335 \\ \hline June & 1757.50 & 1775.80 & & 1729.30 & 1734.40 & -21.90 & 257,707 \\ \hline Aug & 1769.40 & 1787.50 & & 1741.90 & 1746.70 & -21.30 & 165,420 \\ \hline Oct & 1780.00 & 1792.90 & & 1750.50 & 1753.60 & -19.60 & 18,096 \\ \hline Dec & 1780.00 & 1800.00 & & 1756.20 & 1760.60 & -18.10 & 63,563 \\ \hline Feb'21 & 1765.00 & 1775.00 & & 1762.00 & 1763.60 & -17.40 & 10,863 \\ \hline \multicolumn{8}{|c|}{ Palladium (NYM) -50 troy oz; $ per troy oz } \\ \hline May & & & & & 2021.80 & 169.20 & \\ \hline June & 1873.10 & 20770.00 & & 1863.70 & 2027.10 & 169.20 & 3,381 \\ \hline Sept & 1880.00 & 2050.00 & & 1880.00 & 2016.20 & 161.30 & 3,318 \\ \hline Dec & 2000.00 & 2000.00 & & 2000.00 & 2009.20 & 161.50 & 393 \\ \hline \multicolumn{8}{|c|}{ Platinum (NYM) - 50 troy oz; \$ per troy oz. } \\ \hline May & 807.60 & 807.60 & & 805.10 & 86470 & 52.20 & 8 \\ \hline July & 823.10 & 877.00 & & 822.70 & 86930 & 52.20 & 42,602 \\ \hline \multicolumn{8}{|c|}{ Silver (CMX) -5,000 troy oz.; \$ per troy oz } \\ \hline May & 17.220 & 17.585 & & 17.220 & 17.464 & 0.418 & 353 \\ \hline July & 17.225 & 17.985 & & 17.125 & 17.468 & 0.398 & 111,605 \\ \hline \end{tabular} TABLE 23.1 Sample Wall Street Journal Futures Price Quotations \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|c|}{ Metal \& Petroleum Futures } \\ \hline \multicolumn{7}{|c|}{ Contract } & \multirow{2}{*}{\begin{tabular}{r} Open \\ Interest \\ \end{tabular}} \\ \hline & Open & High & hi Lo & Low & Settle & Chg & \\ \hline \multicolumn{8}{|c|}{ Copper-High (CMX)-25,0oo lb; \$ per lb } \\ \hline May & 2.3655 & 2.4260 & & 2.3400 & 2.4050 & 0.0715 & 1,672 \\ \hline July & 2.3375 & 2.4285 & & 2.3340 & 2.4040 & 0.0735 & 99,558 \\ \hline \multicolumn{8}{|c|}{ Gold (CMX)-10o troy oz; \$ per troy oz } \\ \hline May & 175570 & 1770.50 & & 1734.10 & 1731.80 & -21.60 & 1,335 \\ \hline June & 1757.50 & 1775.80 & & 1729.30 & 1734.40 & -21.90 & 257,707 \\ \hline Aug & 1769.40 & 1787.50 & & 1741.90 & 1746.70 & -21.30 & 165,420 \\ \hline Oct & 1780.00 & 1792.90 & & 1750.50 & 1753.60 & -19.60 & 18,096 \\ \hline Dec & 1780.00 & 1800.00 & & 1756.20 & 1760.60 & -18.10 & 63,563 \\ \hline Feb'21 & 1765.00 & 1775.00 & & 1762.00 & 1763.60 & -17.40 & 10,863 \\ \hline \multicolumn{8}{|c|}{ Palladium (NYM) -50 troy oz; $ per troy oz } \\ \hline May & & & & & 2021.80 & 169.20 & \\ \hline June & 1873.10 & 20770.00 & & 1863.70 & 2027.10 & 169.20 & 3,381 \\ \hline Sept & 1880.00 & 2050.00 & & 1880.00 & 2016.20 & 161.30 & 3,318 \\ \hline Dec & 2000.00 & 2000.00 & & 2000.00 & 2009.20 & 161.50 & 393 \\ \hline \multicolumn{8}{|c|}{ Platinum (NYM) - 50 troy oz; \$ per troy oz. } \\ \hline May & 807.60 & 807.60 & & 805.10 & 86470 & 52.20 & 8 \\ \hline July & 823.10 & 877.00 & & 822.70 & 86930 & 52.20 & 42,602 \\ \hline \multicolumn{8}{|c|}{ Silver (CMX) -5,000 troy oz.; \$ per troy oz } \\ \hline May & 17.220 & 17.585 & & 17.220 & 17.464 & 0.418 & 353 \\ \hline July & 17.225 & 17.985 & & 17.125 & 17.468 & 0.398 & 111,605 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started