Question

Suppose you short sell 1000 Intel shares at $20 per share and provide your broker with an initial margin deposit equal to 80% of the

Suppose you short sell 1000 Intel shares at $20 per share and provide your broker with an initial margin deposit equal to 80% of the short sale value. The maintenance margin is 20% (of the short sale liability). The margin account plus the short sale proceeds earn interest for you at a rate of 0.1% per month (credited to your margin account). Intel will pay a $1 dividend per share in 1 month's time. Assume Intel's share price stays approximately flat for 2 months and then spikes upwards. To the nearest cent, how high can the share price spike to in 2 months' time so that you just avoid a margin call?

| a. | $29.16 | |

| b. | $29.22 | |

| c. | $30.00 | |

| d. | $30.06 | |

| e. | None of the above |

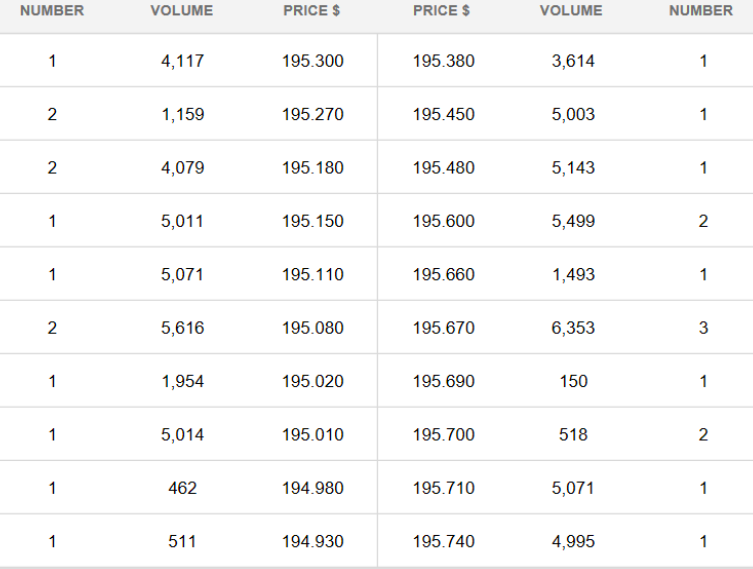

2. Buyers. Sellers

NUMBER VOLUME PRICE $ PRICE $ VOLUME NUMBER 1 4,117 195.300 195.380 3,614 1 2 1,159 195.270 195.450 5,003 1 2 4,079 195.180 195.480 5,143 1 1 5,011 195.150 195.600 5,499 2 1 5,071 195.110 195.660 1,493 1 2 5,616 195.080 195.670 6,353 3 1 1,954 195.020 195.690 150 1 1 5,014 195.010 195.700 518 2 1 462 194.980 195.710 5,071 1 1 511 194.930 195.740 4,995 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started