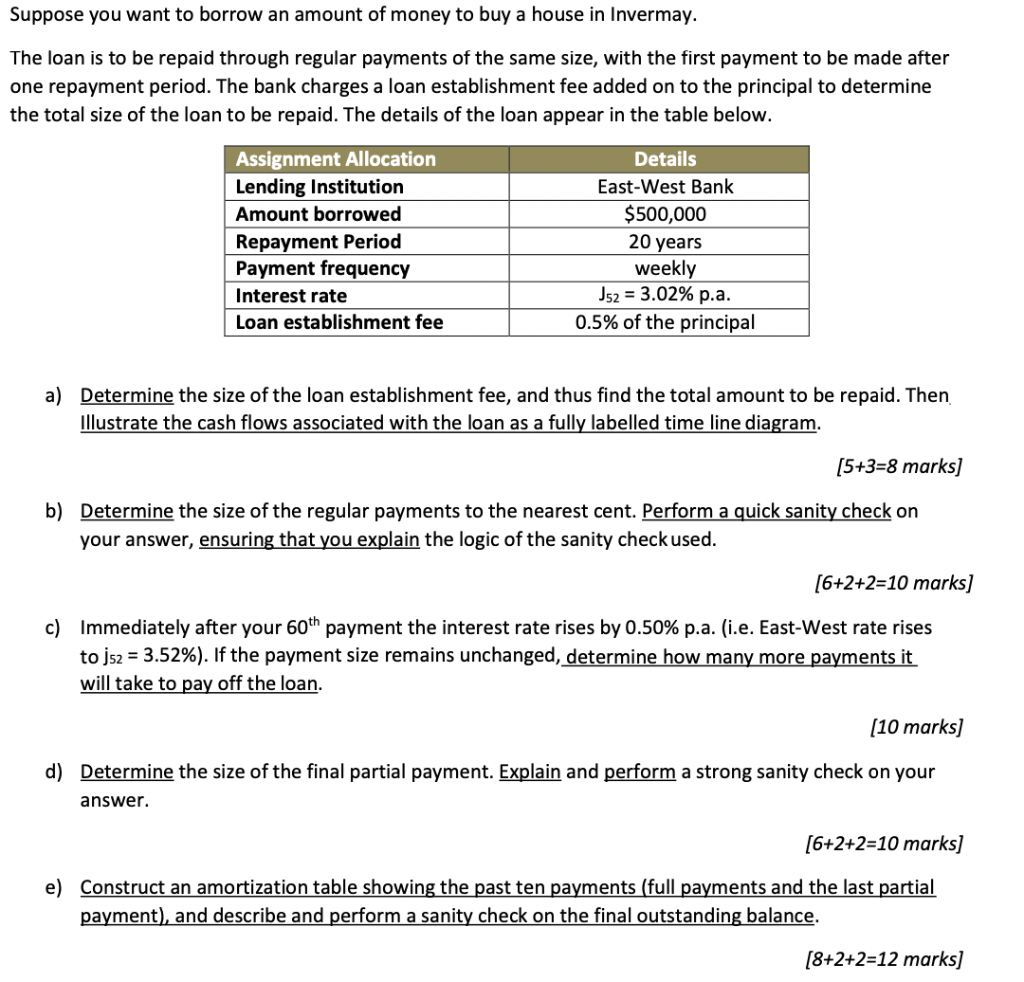

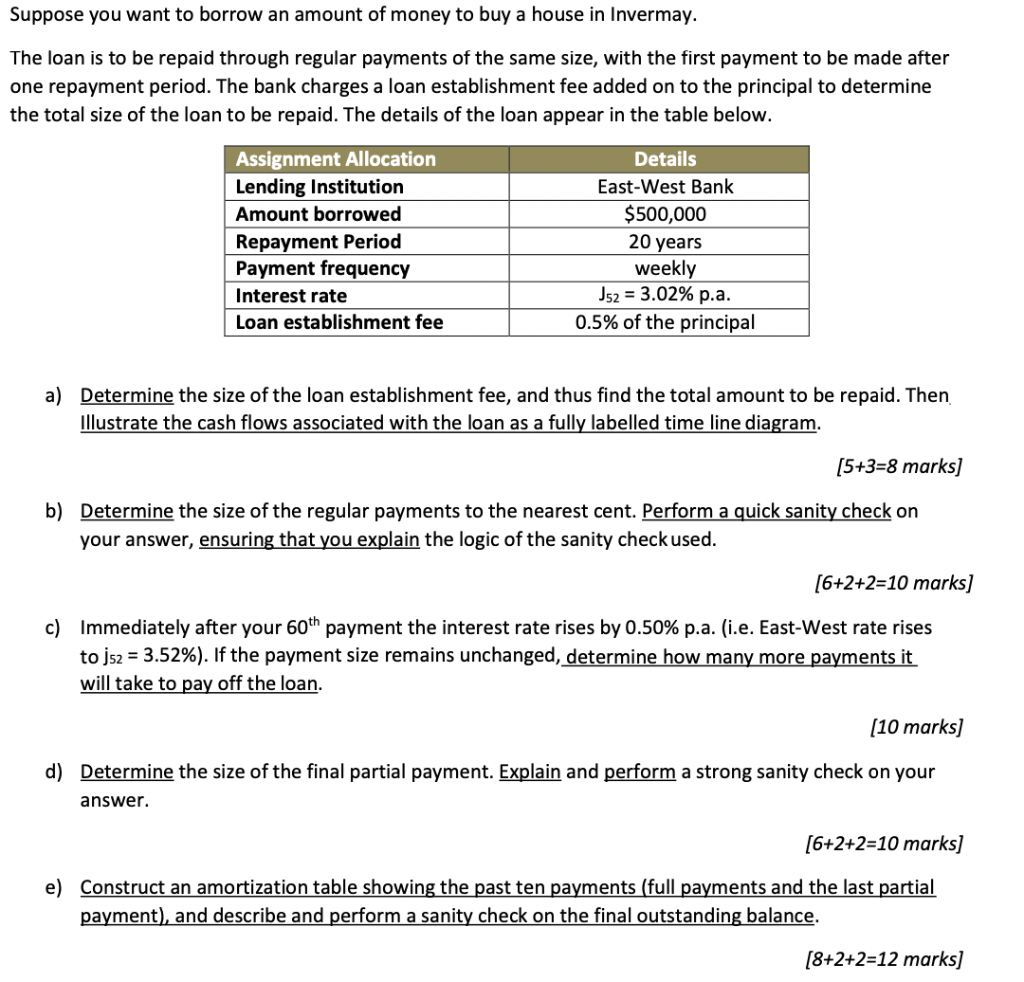

Suppose you want to borrow an amount of money to buy a house in Invermay. The loan is to be repaid through regular payments of the same size, with the first payment to be made after one repayment period. The bank charges a loan establishment fee added on to the principal to determine the total size of the loan to be repaid. The details of the loan appear in the table below. Assignment Allocation Lending Institution Amount borrowed Repayment Period Payment frequency Interest rate Loan establishment fee Details East-West Bank $500,000 20 years weekly J52= 3.02% p.a. 0.5% of the principal a) Determine the size of the loan establishment fee, and thus find the total amount to be repaid. Then Illustrate the cash flows associated with the loan as a fully labelled time line diagram. [5+3=8 marks] b) Determine the size of the regular payments to the nearest cent. Perform a quick sanity check on your answer, ensuring that you explain the logic of the sanity check used. [6+2+2=10 marks] c) Immediately after your 60th payment the interest rate rises by 0.50% p.a. (i.e. East-West rate rises to js2 = 3.52%). If the payment size remains unchanged, determine how many more payments it will take to pay off the loan. [10 marks] d) Determine the size of the final partial payment. Explain and perform a strong sanity check on your answer. [6+2+2=10 marks] e) Construct an amortization table showing the past ten payments (full payments and the last partial payment), and describe and perform a sanity check on the final outstanding balance. [8+2+2=12 marks] Suppose you want to borrow an amount of money to buy a house in Invermay. The loan is to be repaid through regular payments of the same size, with the first payment to be made after one repayment period. The bank charges a loan establishment fee added on to the principal to determine the total size of the loan to be repaid. The details of the loan appear in the table below. Assignment Allocation Lending Institution Amount borrowed Repayment Period Payment frequency Interest rate Loan establishment fee Details East-West Bank $500,000 20 years weekly J52= 3.02% p.a. 0.5% of the principal a) Determine the size of the loan establishment fee, and thus find the total amount to be repaid. Then Illustrate the cash flows associated with the loan as a fully labelled time line diagram. [5+3=8 marks] b) Determine the size of the regular payments to the nearest cent. Perform a quick sanity check on your answer, ensuring that you explain the logic of the sanity check used. [6+2+2=10 marks] c) Immediately after your 60th payment the interest rate rises by 0.50% p.a. (i.e. East-West rate rises to js2 = 3.52%). If the payment size remains unchanged, determine how many more payments it will take to pay off the loan. [10 marks] d) Determine the size of the final partial payment. Explain and perform a strong sanity check on your answer. [6+2+2=10 marks] e) Construct an amortization table showing the past ten payments (full payments and the last partial payment), and describe and perform a sanity check on the final outstanding balance. [8+2+2=12 marks]