Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you want to compare the price sensitivity of two 10-year bonds. Bond A Has a par value of $1,000. Has a coupon rate

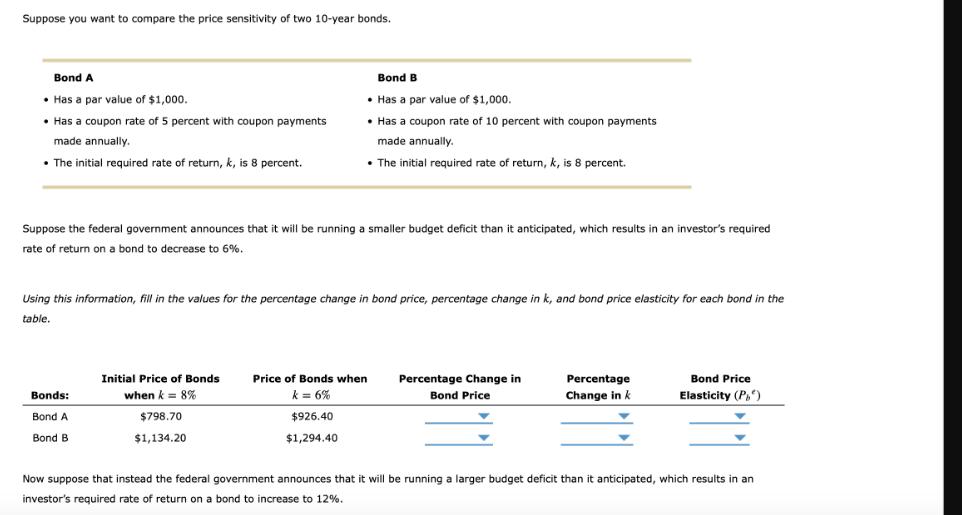

Suppose you want to compare the price sensitivity of two 10-year bonds. Bond A Has a par value of $1,000. Has a coupon rate of 5 percent with coupon payments made annually. The initial required rate of return, k, is 8 percent. Bond B Has a par value of $1,000. Has a coupon rate of 10 percent with coupon payments made annually. The initial required rate of return, k, is 8 percent. Suppose the federal government announces that it will be running a smaller budget deficit than it anticipated, which results in an investor's required rate of return on a bond to decrease to 6%. Using this information, fill in the values for the percentage change in bond price, percentage change in k, and bond price elasticity for each bond in the table. Initial Price of Bonds Bonds: Bond A when k = 8% Price of Bonds when k = 6% Percentage Change in Bond Price Percentage Change in k Bond Price Elasticity (Pb) Bond B $798.70 $1,134.20 $926.40 $1,294.40 Now suppose that instead the federal government announces that it will be running a larger budget deficit than it anticipated, which results in an investor's required rate of return on a bond to increase to 12%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the percentage change in bond price we can use the following formula Percentage Change ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started