Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you were offered an investment promising to pay the following annual cash flows, after which the investment would have no real value. If

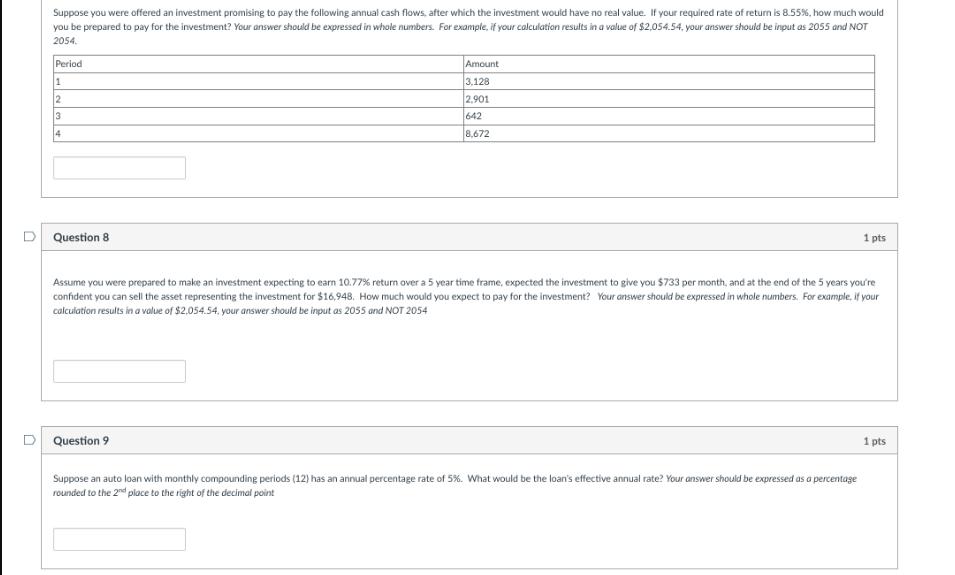

Suppose you were offered an investment promising to pay the following annual cash flows, after which the investment would have no real value. If your required rate of return is 8.55%, how much would you be prepared to pay for the investment? Your answer should be expressed in whole numbers. For example, if your calculation results in a value of $2,054.54, your answer should be input as 2055 and NOT 2054. Period 1 2 3 4 Question 8 Amount 3,128 2,901 642 8,672 1 pts Assume you were prepared to make an investment expecting to earn 10.77% return over a 5 year time frame, expected the investment to give you $733 per month, and at the end of the 5 years you're confident you can sell the asset representing the investment for $16,948. How much would you expect to pay for the investment? Your answer should be expressed in whole numbers. For example, if your calculation results in a value of $2,054.54, your answer should be input as 2055 and NOT 2054 Question 9 Suppose an auto loan with monthly compounding periods (12) has an annual percentage rate of 5%. What would be the loan's effective annual rate? Your answer should be expressed as a percentage rounded to the 2nd place to the right of the decimal point 1 pts

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

For Question 8 To calculate the present value of the cash flows we use the formula for the present v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642b4a18c506_975638.pdf

180 KBs PDF File

6642b4a18c506_975638.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started