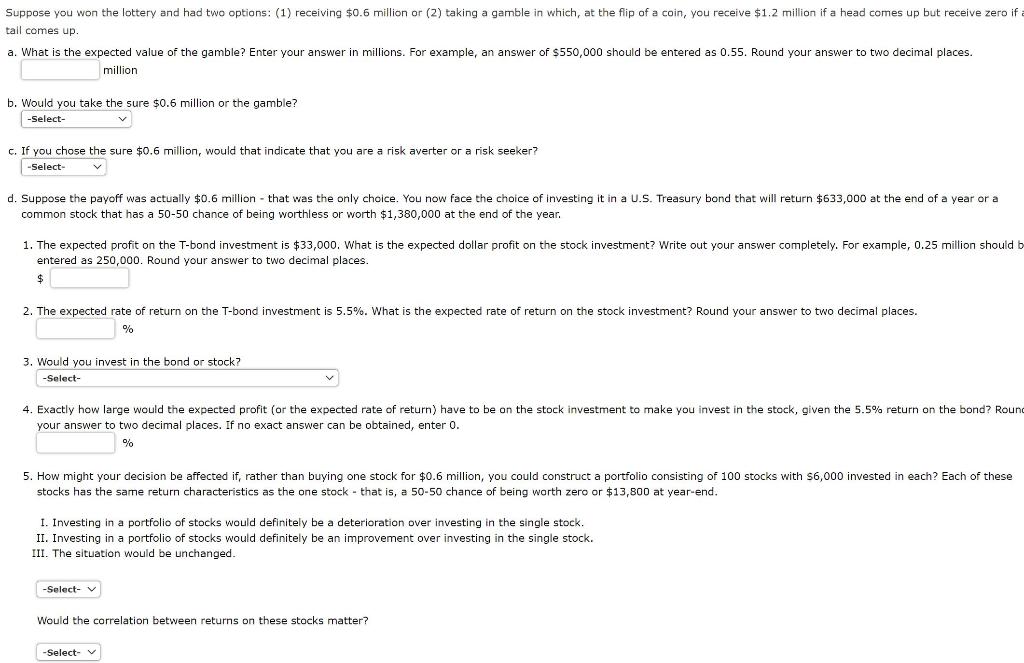

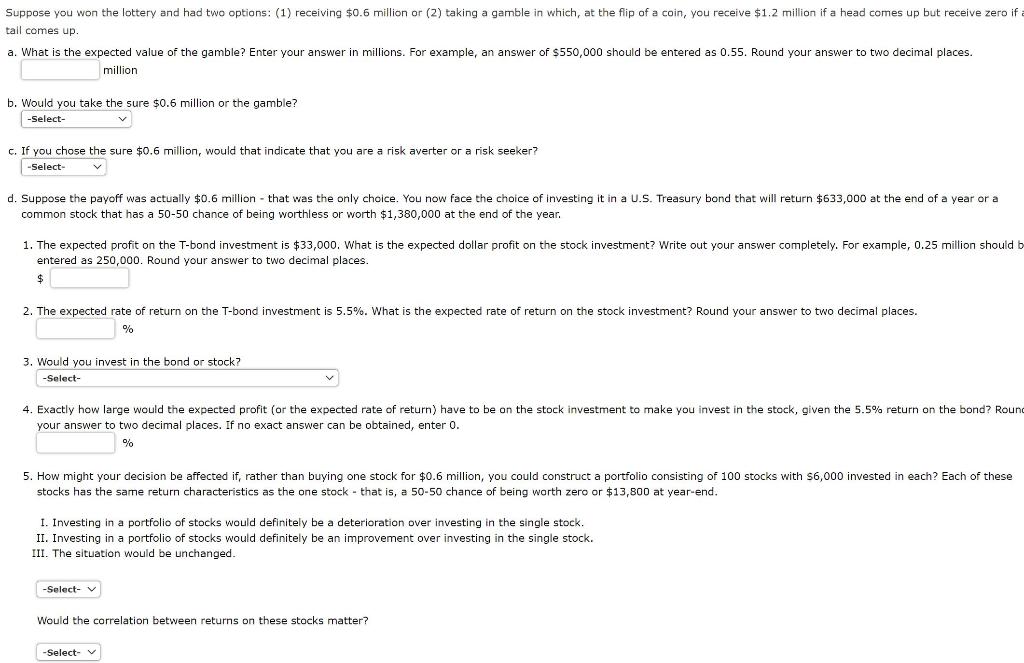

Suppose you won the lottery and had two options: (1) receiving $0.6 million or (2) taking a gamble in which, at the flip of a coin, you receive $1.2 million if a head comes up but receive zero if a tail comes up a. What is the expected value of the gamble? Enter your answer in millions. For example, an answer of $550,000 should be entered as 0.55. Round your answer to two decimal places. million b. Would you take the sure $0.6 million or the gamble? -Select- c. If you chose the sure $0.6 million, would that indicate that you are a risk averter or a risk seeker? -Select d. Suppose the payoff was actually $0.6 million that was the only choice. You now face the choice of investing it in a U.S. Treasury bond that will return $633,000 at the end of a year or a common stock that has a 50-50 chance of being worthless or worth $1,380,000 at the end of the year. 1. The expected profit on the T-bond investment is $33,000. What is the expected dollar profit on the stock investment? Write out your answer completely. For example, 0.25 million should b entered as 250,000. Round your answer to two decimal places. $ 5.5%. What is the expected rate of return on the stock investment? Round your answer to two decimal places. 2. The expected rate of return on the T-bond investment % 3. Would you invest in the bond or stock? -Select- 4. Exactly how large would the expected profit (or the expected rate of return) have to be on the stock investment to make you invest in the stock, given the 5.5% return on the bond? Round your answer to two decimal places. If no exact answer can be obtained, enter 0. % 5. How might your decision be affected if, rather than buying one stock for $0.6 million, you could construct a portfolio consisting of 100 stocks with 6,000 invested in each? Each of these stocks has the same return characteristics as the one stock - that is, a 50-50 chance of being worth zero or $13,800 at year-end. I. Investing in a portfolio of stocks would definitely be a deterioration over investing in the single stock. II. Investing in a portfolio of stocks would definitely be an improvement over investing in the single stock. III. The situation would be unchanged. -Select- Would the correlation between returns on these stocks matter? -Select