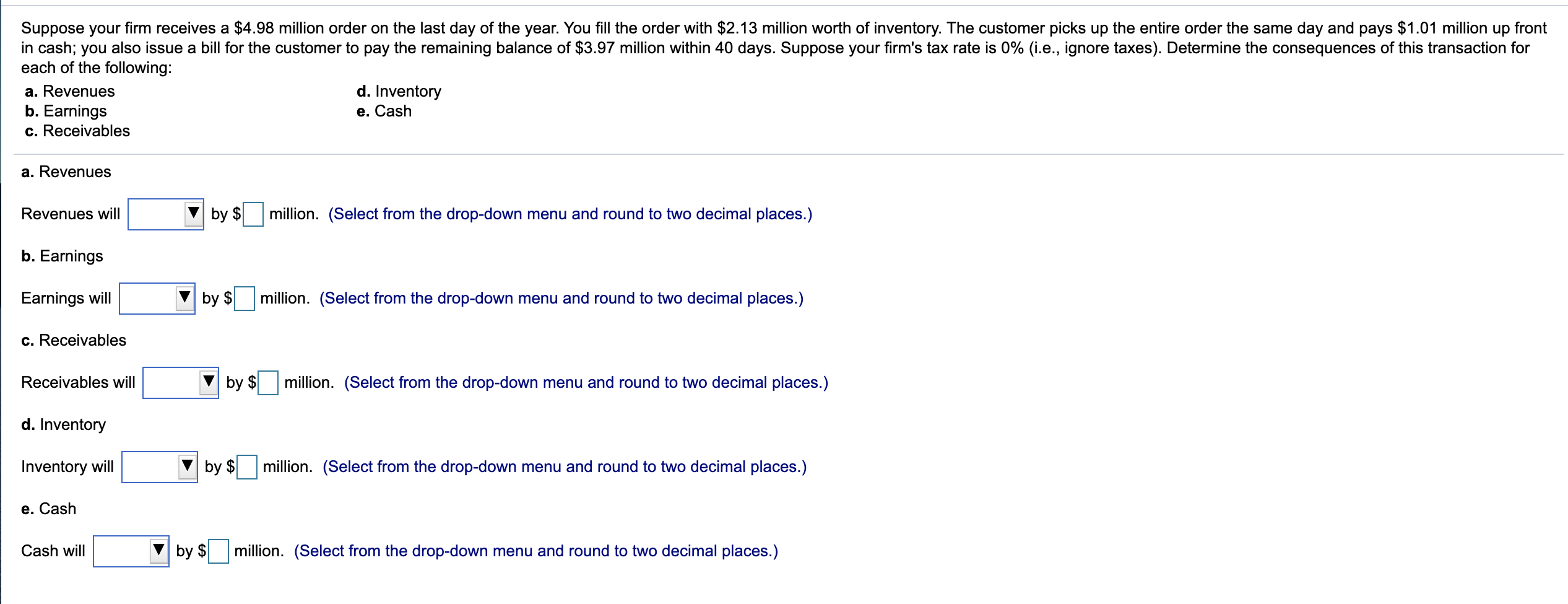

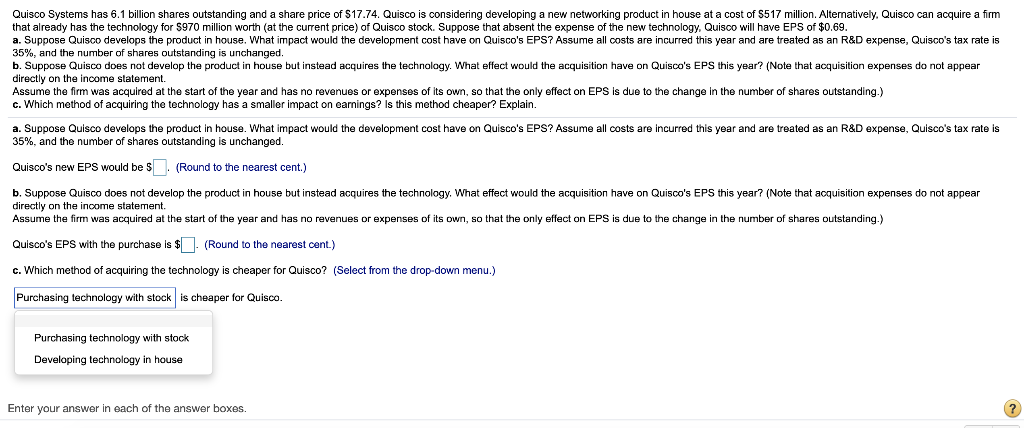

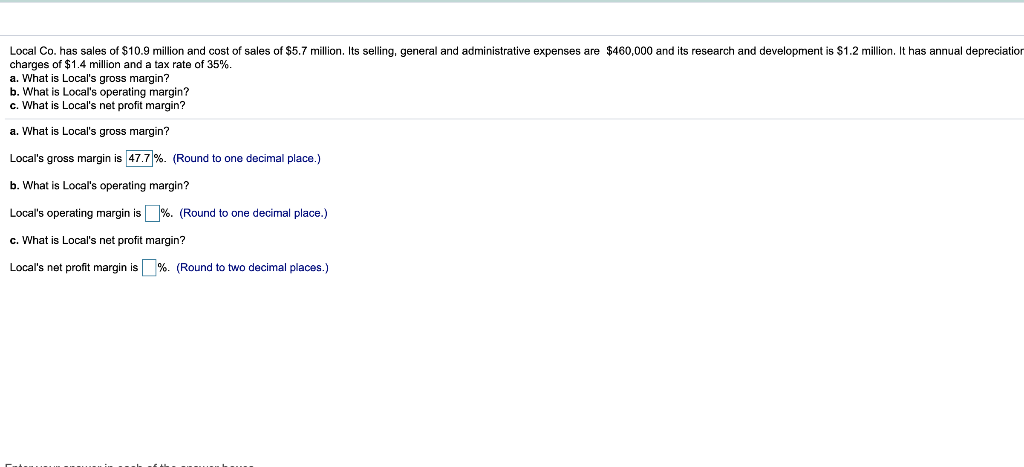

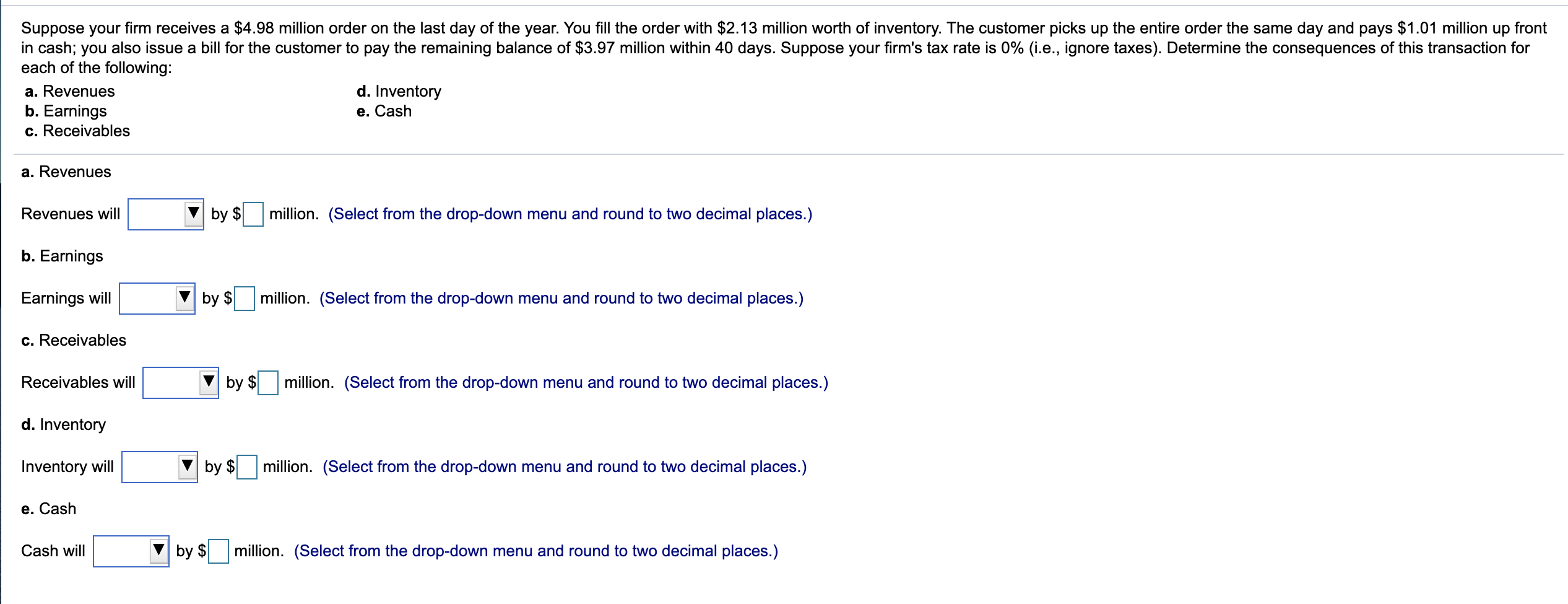

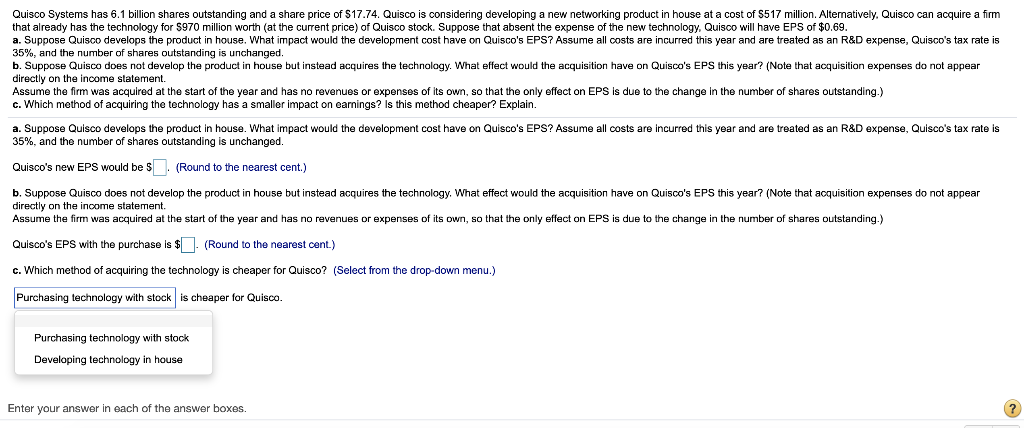

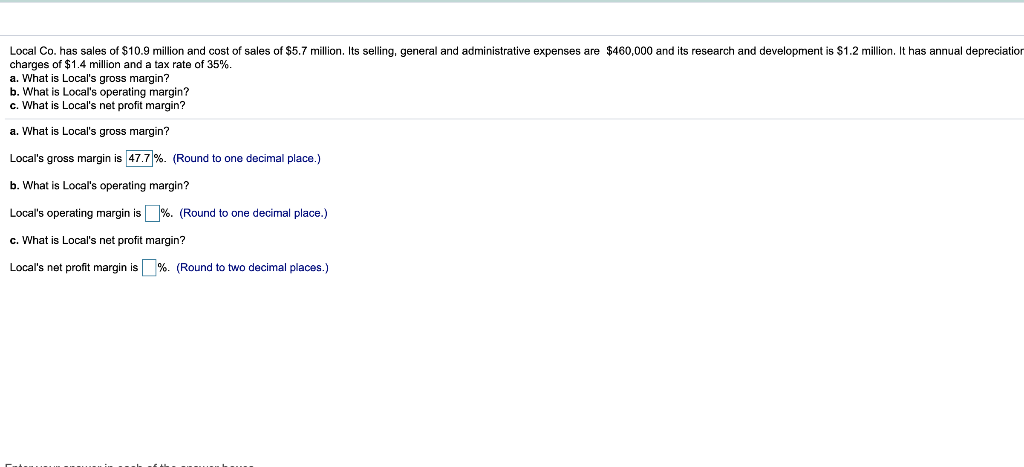

Suppose your firm receives a $4.98 million order on the last day of the year. You fill the order with $2.13 million worth of inventory. The customer picks up the entire order the same day and pays $1.01 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $3.97 million within 40 days. Suppose your firm's tax rate is 0% (i.e., ignore taxes). Determine the consequences of this transaction for each of the following: a. Revenues d. Inventory b. Earnings e. Cash c. Receivables a. Revenues Revenues will by $ million. (Select from the drop-down menu and round to two decimal places.) b. Earnings Earnings will by $ million. (Select from the drop-down menu and round to two decimal places.) c. Receivables Receivables will by $ million. (Select from the drop-down menu and round to two decimal places.) d. Inventory Inventory will by $ million. (Select from the drop-down menu and round to two decimal places.) e. Cash Cash will by $ million. (Select from the drop-down menu and round to two decimal places.) Quisco Systems has 6.1 billion shares outstanding and a share price of $17.74. Quisco is considering developing a new networking product in house at a cost of $517 million. Alternatively. Quisco can acquire a firm that already has the technology for $970 million worth (at the current price) of Quisco stock. Suppose that absent the expense of the new technology, Quisco will have EPS of $0.69. a. Suppose Quisco develops the product in house. What impact would the development cost have on Quisco's EPS? Assume all costs are incurred this year and are treated as an R&D expense, Quisco's tax rate is 35%, and the number of shares outstanding is unchanged. b. Suppose Quisco does not develop the product in house but instead acquires the technology. What effect would the acquisition have on Quisco's EPS this year? (Note that acquisition expenses do not appear directly on the income statement. Assume the firm was acquired at the start of the year and has no revenues or expenses of its own, so that the only effect on EPS is due to the change in the number of shares outstanding.) c. Which method of acquiring the technology has a smaller impact on earnings? Is this method cheaper? Explain. a. Suppose Quisco develops the product house. What impact would the development cost have on Quisco's EPS? Assume all costs are incurred this year and are treated as an R&D expense, Quisco's tax rate is 35%, and the number of shares outstanding is unchanged. Quisco's new EPS would be $ (Round to the nearest cent.) b. Suppose Quisco does not develop the product in house but instead acquires the technology. What effect would the acquisition have on Quisco's EPS this year? (Note that acquisition expenses do not appear directly on the income statement. Assume the firm was acquired at the start of the year and has no revenues or expenses of its own, so that the only effect on EPS is due to the change in the number shares outstanding.) Quisco's EPS with the purchase is $. (Round to the nearest cent.) c. Which method of acquiring the technology is cheaper for Quisco? (Select from the drop-down menu.) Purchasing technology with stock cheaper for Quisco. Purchasing technology with stock Developing technology in house Enter your answer in each of the answer boxes. ? Local Co. has sales of $10.9 million and cost of sales of $5.7 million. Its selling, general and administrative expenses are $460,000 and its research and development is $1.2 million. It has annual depreciation charges of $1.4 million and a tax rate of 35%. a. What is Local's gross margin? b. What is Local's operating margin? c. What is Local's net profit margin? a. What is Local's gross margin? Local's gross margin is 47.7%. (Round to one decimal place.) b. What is Local's operating margin? Local's operating margin is %. (Round to one decimal place.) c. What is Local's net profit margin? Local's net profit margin is %. (Round to two decimal places.)