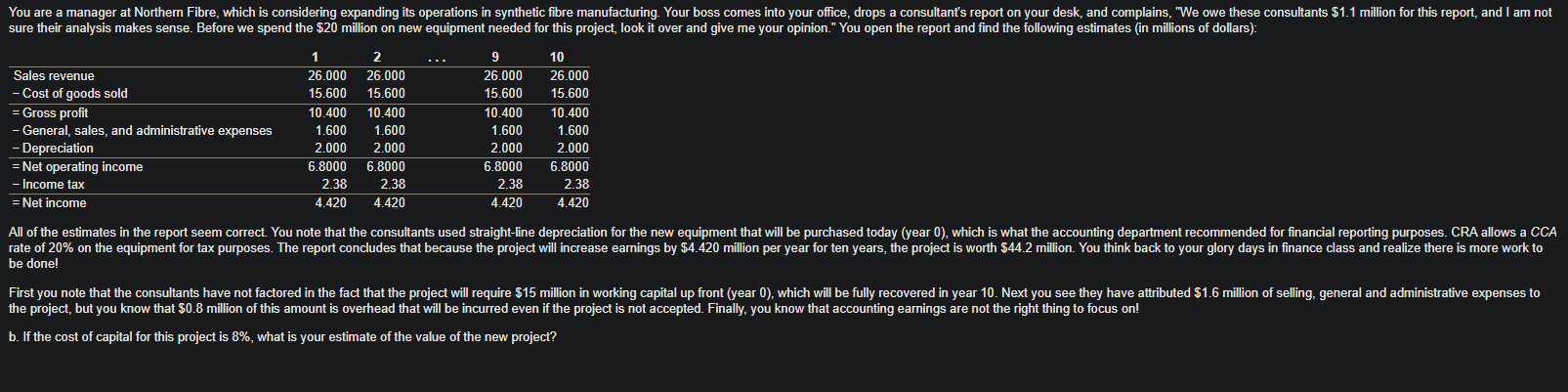

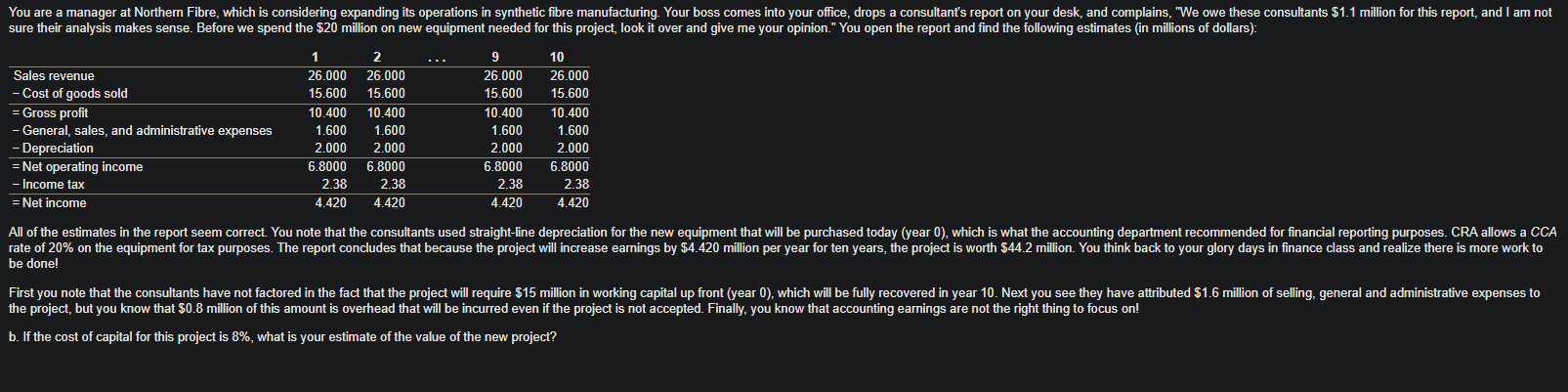

sure their analysis makes sense. Before we spend the $20 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): \begin{tabular}{lrrrrr} & 1 & \multicolumn{1}{c}{2} & \multicolumn{1}{c}{1} & \multicolumn{1}{c}{9} & \multicolumn{1}{c}{10} \\ \hline Sales revenue & 26.000 & 26.000 & & 26.000 & 26.000 \\ - Cost of goods sold & 15.600 & 15.600 & & 15.600 & 15.600 \\ \hline - Gross profit & 10.400 & 10.400 & & 10.400 & 10.400 \\ - General, sales, and administrative expenses & 1.600 & 1.600 & & 1.600 & 1.600 \\ - Depreciation & 2.000 & 2.000 & & 2.000 & 2.000 \\ \hline - Net operating income & 6.8000 & 6.8000 & & 6.8000 & 6.8000 \\ - Income tax & 2.38 & 2.38 & & 2.38 & 2.38 \\ \hline - Net income & 4.420 & 4.420 & & 4.420 & 4.420 \end{tabular} the project, but you know that $0.8 million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to focus on! b. If the cost of capital for this project is 8%, what is your estimate of the value of the new project? sure their analysis makes sense. Before we spend the $20 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): \begin{tabular}{lrrrrr} & 1 & \multicolumn{1}{c}{2} & \multicolumn{1}{c}{1} & \multicolumn{1}{c}{9} & \multicolumn{1}{c}{10} \\ \hline Sales revenue & 26.000 & 26.000 & & 26.000 & 26.000 \\ - Cost of goods sold & 15.600 & 15.600 & & 15.600 & 15.600 \\ \hline - Gross profit & 10.400 & 10.400 & & 10.400 & 10.400 \\ - General, sales, and administrative expenses & 1.600 & 1.600 & & 1.600 & 1.600 \\ - Depreciation & 2.000 & 2.000 & & 2.000 & 2.000 \\ \hline - Net operating income & 6.8000 & 6.8000 & & 6.8000 & 6.8000 \\ - Income tax & 2.38 & 2.38 & & 2.38 & 2.38 \\ \hline - Net income & 4.420 & 4.420 & & 4.420 & 4.420 \end{tabular} the project, but you know that $0.8 million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to focus on! b. If the cost of capital for this project is 8%, what is your estimate of the value of the new project