Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Survivor has been leasing a 600m floor at the Victory house, for an annual rental of $120,000 per annum, payable at the end of

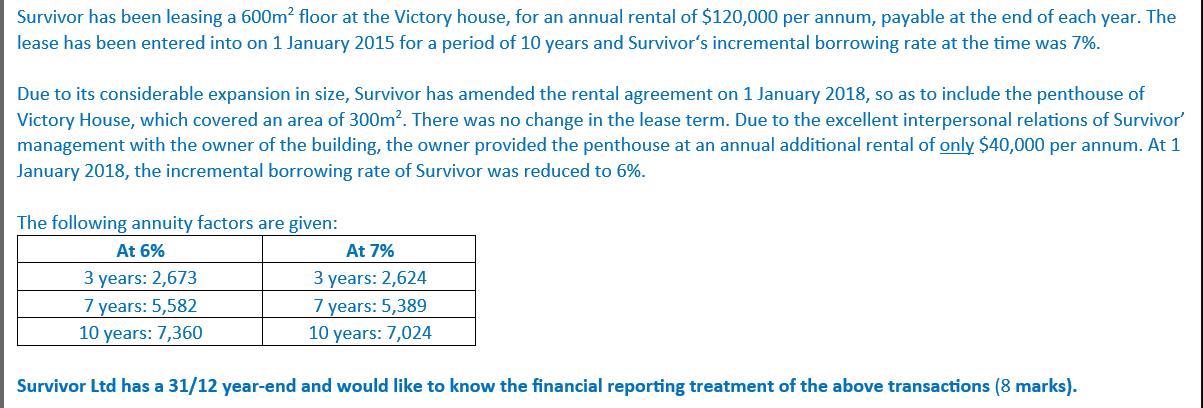

Survivor has been leasing a 600m floor at the Victory house, for an annual rental of $120,000 per annum, payable at the end of each year. The lease has been entered into on 1 January 2015 for a period of 10 years and Survivor's incremental borrowing rate at the time was 7%. Due to its considerable expansion in size, Survivor has amended the rental agreement on 1 January 2018, so as to include the penthouse of Victory House, which covered an area of 300m. There was no change in the lease term. Due to the excellent interpersonal relations of Survivor' management with the owner of the building, the owner provided the penthouse at an annual additional rental of only $40,000 per annum. At 1 January 2018, the incremental borrowing rate of Survivor was reduced to 6%. The following annuity factors are given: At 6% 3 years: 2,673 7 years: 5,582 10 years: 7,360 At 7% 3 years: 2,624 7 years: 5,389 10 years: 7,024 Survivor Ltd has a 31/12 year-end and would like to know the financial reporting treatment of the above transactions (8 marks).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started