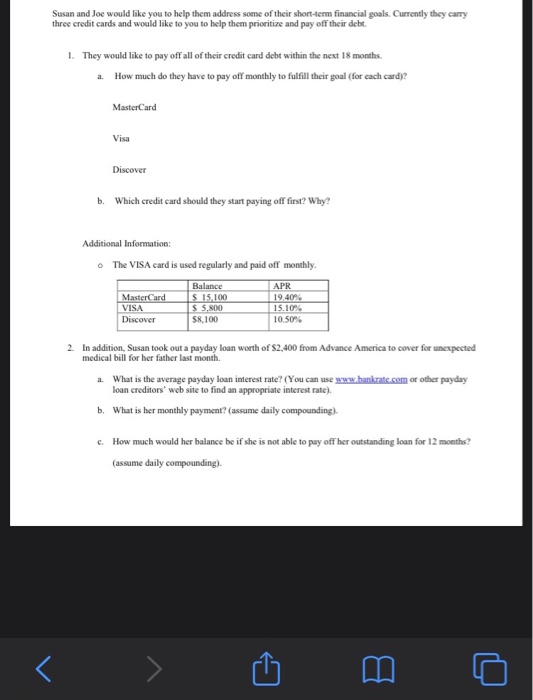

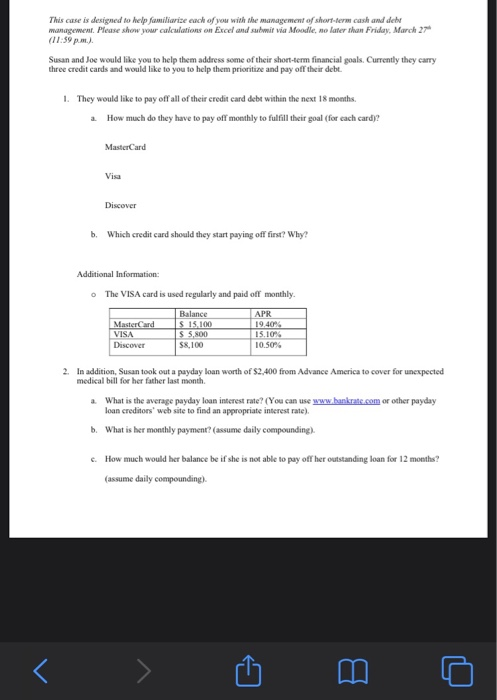

Susan and Joe would like you to help them address some of their short-term financial goals. Currently they carry three credit cards and would like to you to help them prioritize and pay off their debt 1. They would like to pay off all of their credit card debt within the next 18 months. a How much do they have to pay off monthly to fulfill their goal for each card? MasterCard Visa Discover b. Which credit card should they start paying off first? Why? Additional Information: The VISA card is used regularly and paid off monthly MasterCard VISA Discover Balance S 15.100 1510 S . 800 $8.100 APR 1 940 15.10% 10.50% 2. In addition, Susan took out a payday loan worth of $2,400 from Advance America to cover for unexpected medical bill for her father last month. a. What is the average payday loan interest rate? (You can use www.bankrate.com or other payday loan creditors' web site to find an appropriate interest rate). b. What is her monthly payment? (assume daily compounding) c. How much would her balance be if she is not able to pay off her outstanding loan for 12 months (assume daily compounding) This case is designed to help familiarde euch of you with the management of short-term cash and dele management. Please show your calculations on Excel and s ilvia Moodle materia Priday March 27 (11 5 Susan and Joe would like you to help them address some of their short-term financial goals. Currently they carry the credit cards and would like to you to help them prioritize and pay off their debe 1. They would like to pay off all of their credit card debt within the next 18 months a How much do they have to pay off monthly to fulfill their goal for each card)? MasterCard Visa Discover b. Which credit card should they start paying off first? Why? Additional Information: The VISA card is used regularly and paid off monthly MasterCard VISA Discover Balance S 15.100 IS SNOO $8,100 APR 19,40% 15.10 10.50 2. In addition, Susan took out a payday loan worth of $2.400 from Advance America to cover for unexpected medical bill for her father last month. What is the average payday loan interest rate? (You can use www.bankrats.com or other payday loan creditors' web site to find an appropriate interest rate). b. What is her monthly payment? (assume daily compounding) 6. How much would her balance be if she is not able to pay off her outstanding loan for 12 months? (assume daily compounding)