Answered step by step

Verified Expert Solution

Question

1 Approved Answer

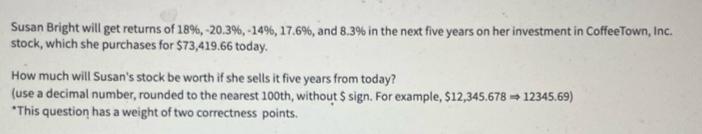

Susan Bright will get returns of 18%, -20.39%, -14%, 17.6%, and 8.3% in the next five years on her investment in Coffee Town, Inc.

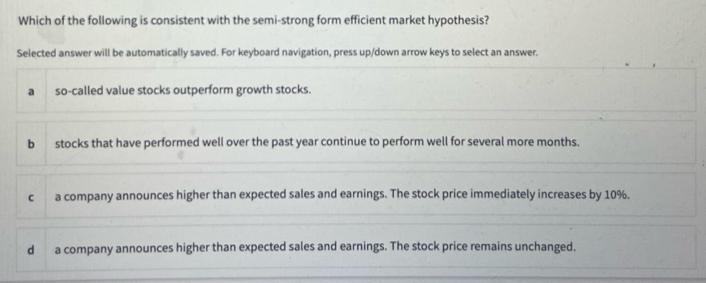

Susan Bright will get returns of 18%, -20.39%, -14%, 17.6%, and 8.3% in the next five years on her investment in Coffee Town, Inc. stock, which she purchases for $73,419.66 today. How much will Susan's stock be worth if she sells it five years from today? (use a decimal number, rounded to the nearest 100th, without $ sign. For example, $12,345.67812345.69) *This question has a weight of two correctness points. Which of the following is consistent with the semi-strong form efficient market hypothesis? Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. so-called value stocks outperform growth stocks. a stocks that have performed well over the past year continue to perform well for several more months. a company announces higher than expected sales and earnings. The stock price immediately increases by 10%. d a company announces higher than expected sales and earnings. The stock price remains unchanged.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Susans Stock Value in Five Years Apply ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started