Question

Susan Company produces a product called N96 which required to go through two processes, Process 1 andProcess 2. The following information relates to Process 2

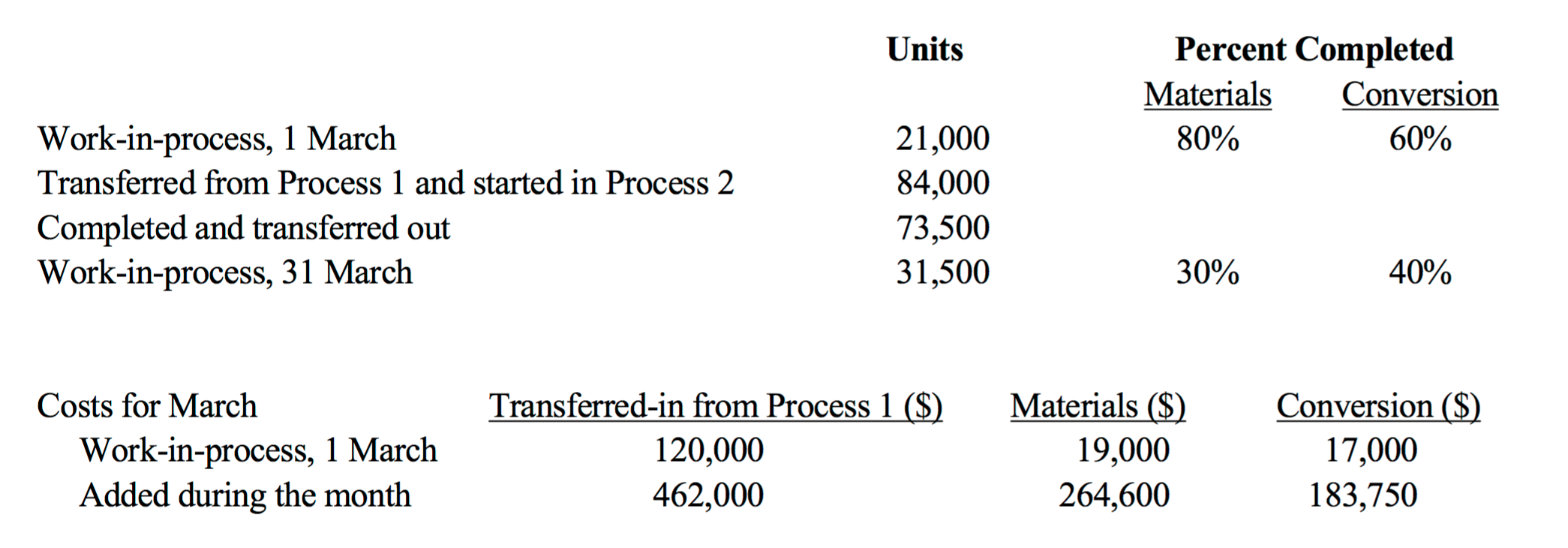

Susan Company produces a product called N96 which required to go through two processes, Process 1 andProcess 2. The following information relates to Process 2 for the month of March 2020:

It is the companys policy to adopt FIFO method in its process costing system.

Required:

(a) Determine the equivalent units for transferred-in from Process 1, materials and conversion for March.

(b) Determine the cost per equivalent unit for transferred-in from Process 1, materials and conversion for March.

(c) Determine the total cost of ending work-in-process inventory and the total cost of units transferred to finished goods in March.

(d) Briefly explain how the adoption of a lean manufacturing approach affects process costing.

(e) Normal loss is included in the cost of good output units, while abnormal loss is recorded as a period cost. Comment on this statement.

Units Percent Completed Materials Conversion 80% 60% Work-in-process, 1 March Transferred from Process 1 and started in Process 2 Completed and transferred out Work-in-process, 31 March 21,000 84,000 73,500 31,500 30% 40% Costs for March Work-in-process, 1 March Added during the month Transferred-in from Process 1 ($) 120,000 462,000 Materials ($) 19,000 264,600 Conversion ($) 17,000 183,750Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started