Question

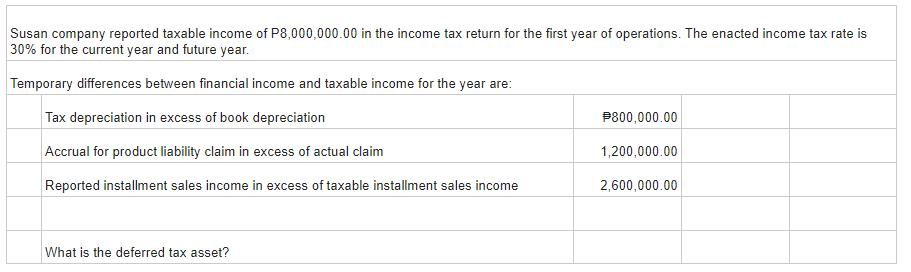

Susan company reported taxable income of P8,000,000.00 in the income tax return for the first year of operations. The enacted income tax rate is

Susan company reported taxable income of P8,000,000.00 in the income tax return for the first year of operations. The enacted income tax rate is 30% for the current year and future year. Temporary differences between financial income and taxable income for the year are: Tax depreciation in excess of book depreciation Accrual for product liability claim in excess of actual claim Reported installment sales income in excess of taxable installment sales income What is the deferred tax asset? $800,000.00 1,200,000.00 2,600,000.00

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the deferred tax asset we need to determine the temporary differences and apply the ena...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

2nd edition

9781305727557, 1285453824, 9781337116619, 130572755X, 978-1285453828

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App