Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susan earns $80,000 a year. She is the sole provider for her two children aged 7 and 8 whom she expects will finish school

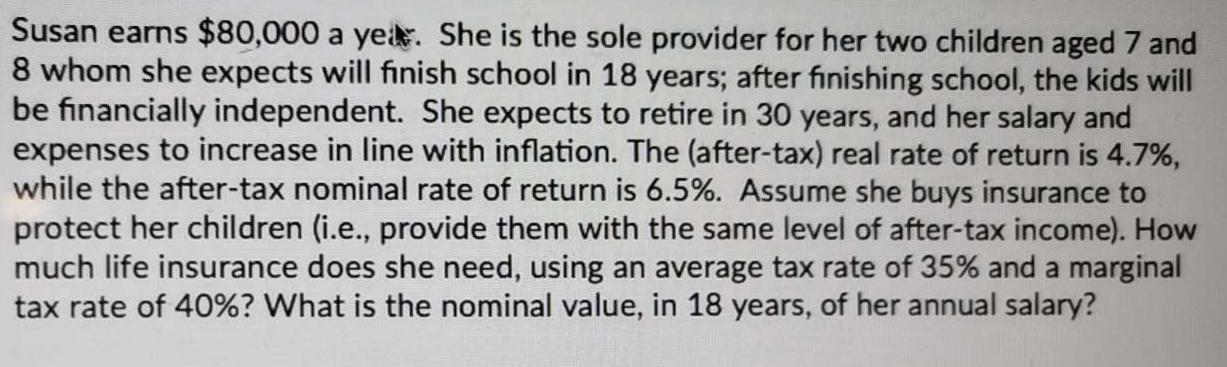

Susan earns $80,000 a year. She is the sole provider for her two children aged 7 and 8 whom she expects will finish school in 18 years; after finishing school, the kids will be financially independent. She expects to retire in 30 years, and her salary and expenses to increase in line with inflation. The (after-tax) real rate of return is 4.7%, while the after-tax nominal rate of return is 6.5%. Assume she buys insurance to protect her children (i.e., provide them with the same level of after-tax income). How much life insurance does she need, using an average tax rate of 35% and a marginal tax rate of 40%? What is the nominal value, in 18 years, of her annual salary?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the life insurance needed we need to calculate the present value of Susans future incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started