Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susan graduated ten years ago and started her career at Reliant Corporation ( in 2 0 1 4 ) . Throughout the past ten years

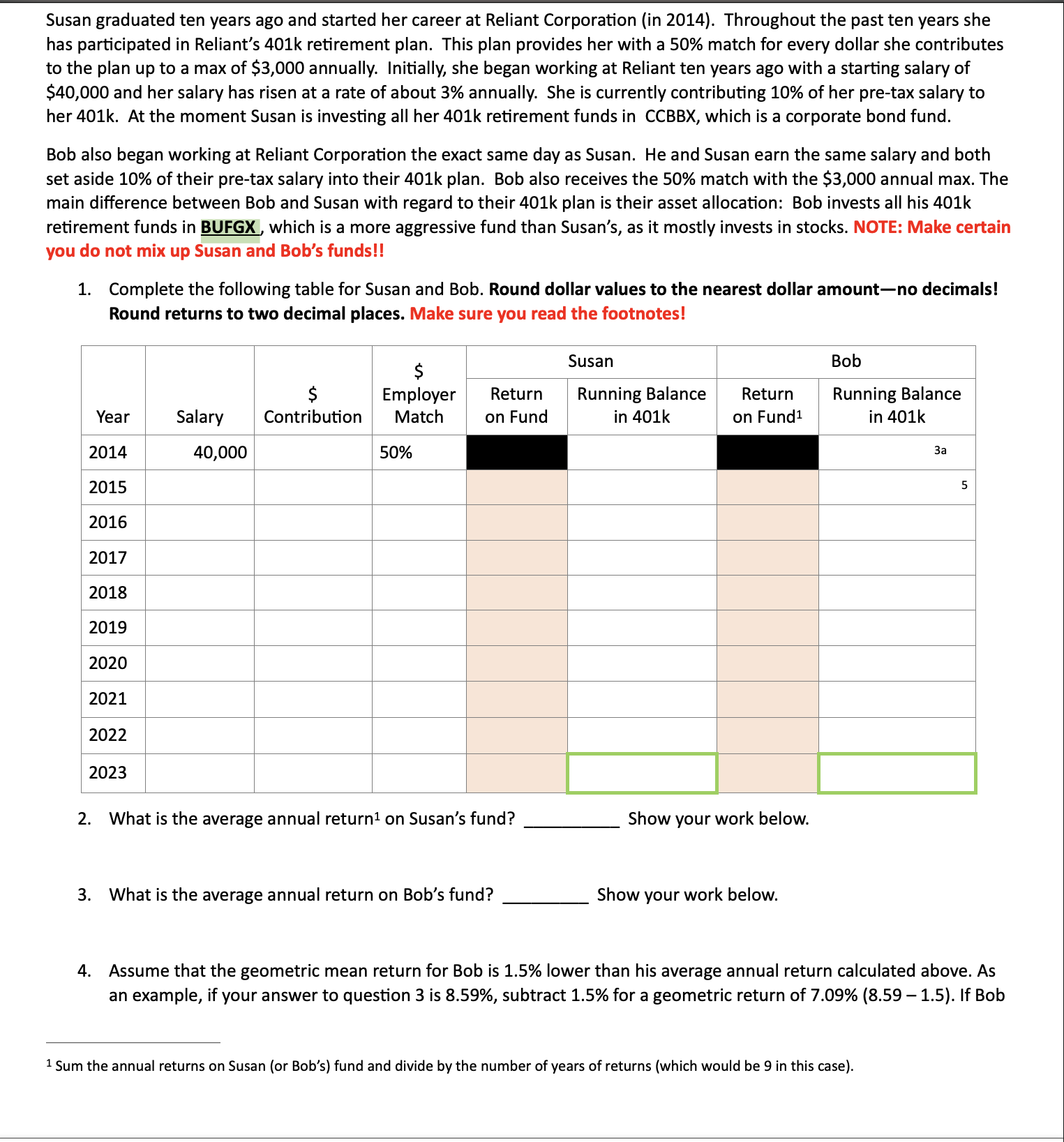

Susan graduated ten years ago and started her career at Reliant Corporation in Throughout the past ten years she has participated in Reliant's k retirement plan. This plan provides her with a match for every dollar she contributes to the plan up to a max of $ annually. Initially, she began working at Reliant ten years ago with a starting salary of $ and her salary has risen at a rate of about annually. She is currently contributing of her pretax salary to her k At the moment Susan is investing all her k retirement funds in CCBBX which is a corporate bond fund.

Bob also began working at Reliant Corporation the exact same day as Susan. He and Susan earn the same salary and both set aside of their pretax salary into their k plan. Bob also receives the match with the $ annual max. The main difference between Bob and Susan with regard to their k plan is their asset allocation: Bob invests all his k retirement funds in BUFGX, which is a more aggressive fund than Susan's, as it mostly invests in stocks. Susan and Bob. Round dollar values to the nearest dollar amountno decimals! Round returns to two decimal places.

What is the average annual return on Susan's fund? What is the average annual return on Bob's fund?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started