Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susan is a single mother with three children. She is a cashier at a food market earning $7.75 per hour and works up to 2,000

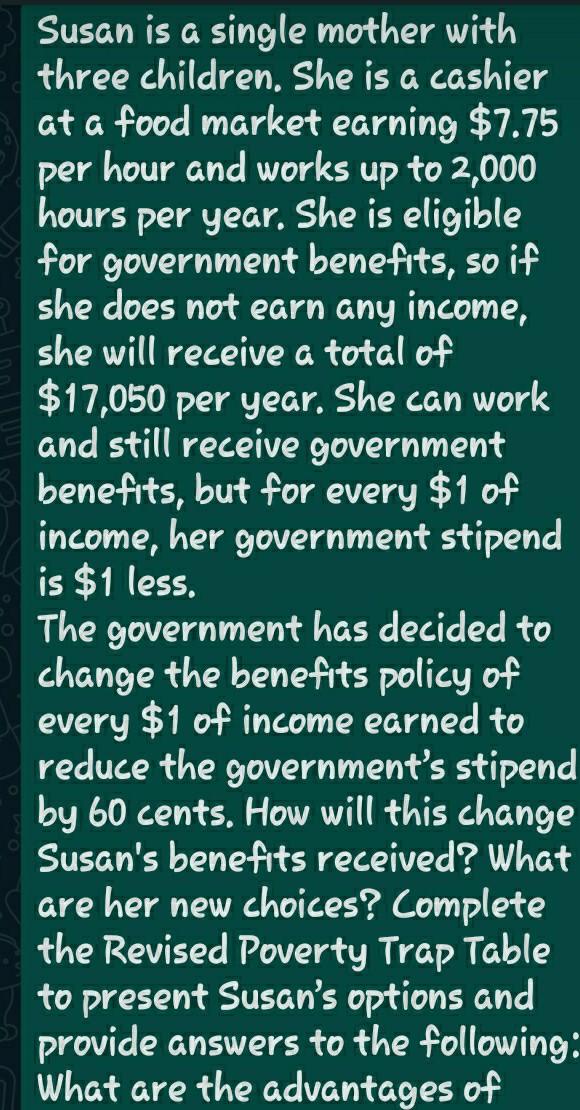

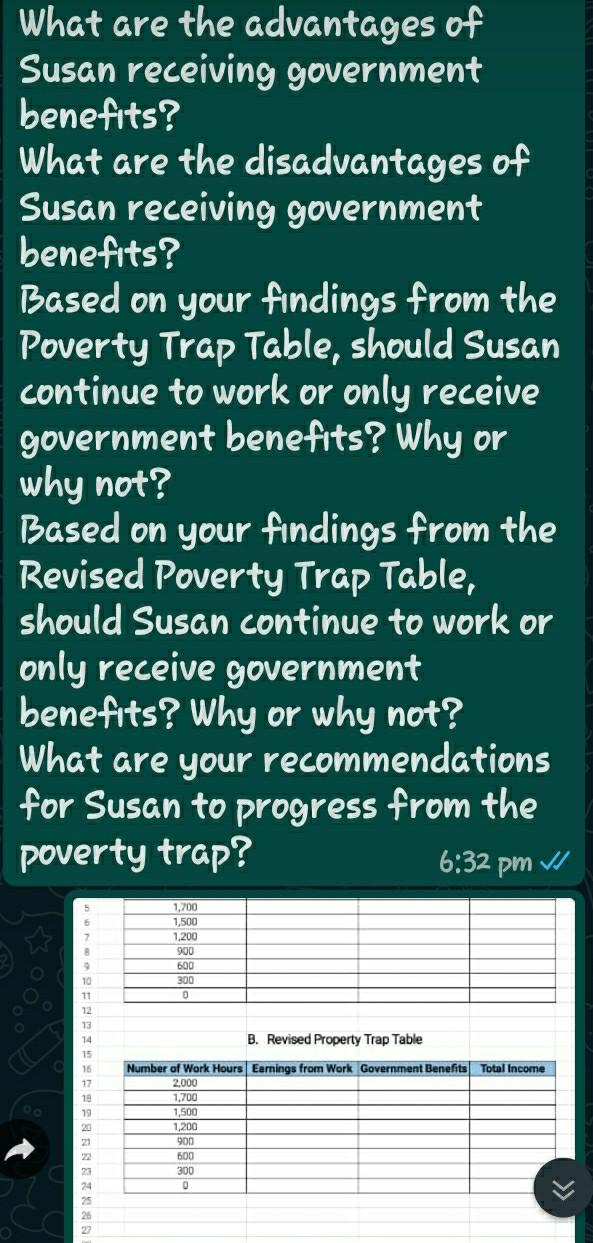

Susan is a single mother with three children. She is a cashier at a food market earning $7.75 per hour and works up to 2,000 hours per year. She is eligible for government benefits, so if she does not earn any income, she will receive a total of $17,050 per year. She can work and still receive government benefits, but for every $1 of income, her government stipend is $1 less. The government has decided to change the benefits policy of every $1 of income earned to reduce the government's stipend by 60 cents. How will this change Susan's benefits received? What are her new choices? Complete the Revised Poverty Trap Table to present Susan's options and provide answers to the following: What are the advantages of What are the advantages of Susan receiving government benefits? What are the disadvantages of Susan receiving government benefits? Based on your findings from the Poverty Trap Table, should Susan continue to work or only receive government benefits? Why or why not? Based on your findings from the Revised Poverty Trap Table, should Susan continue to work or only receive government benefits? Why or why not? What are your recommendations for Susan to progress from the poverty trap? 6:32 pm VI 1,700 1,500 7,200 900 600 300 0 B. Revised Property Trap Table 12 13 14 15 16 17 19 79 20 27 Number of Work Hours Earnings from Work Government Benefits Total Income 2.000 1,700 1,500 1,200 900 600 300 23 25 26 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started