Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susan is an executive at a commercial bank. Susan has been asked to provide a risk assessment using VaR to estimate the risk exposure

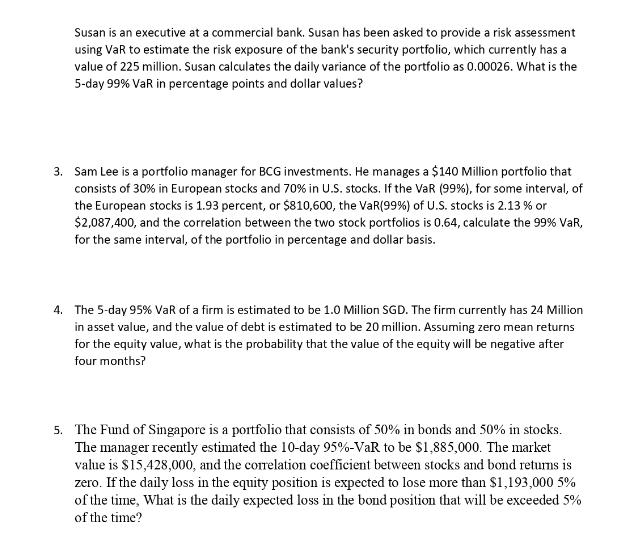

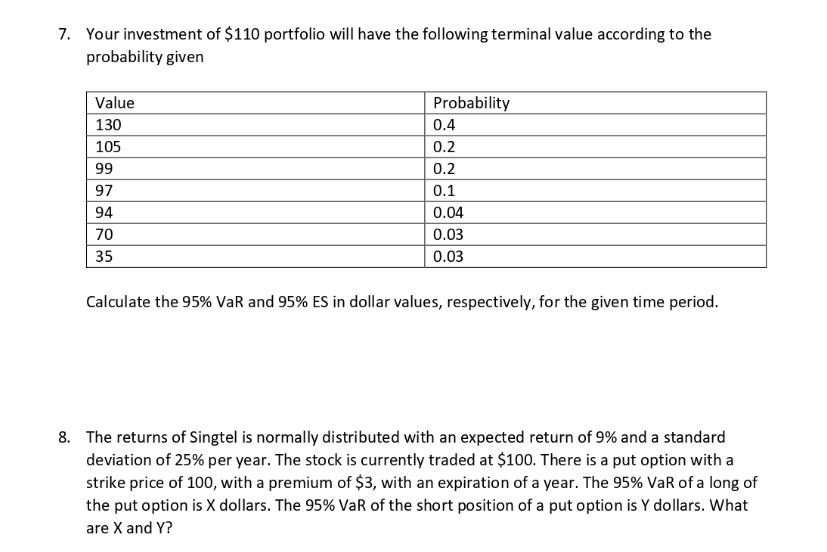

Susan is an executive at a commercial bank. Susan has been asked to provide a risk assessment using VaR to estimate the risk exposure of the bank's security portfolio, which currently has a value of 225 million. Susan calculates the daily variance of the portfolio as 0.00026. What is the 5-day 99% VaR in percentage points and dollar values? 3. Sam Lee is a portfolio manager for BCG investments. He manages a $140 Million portfolio that consists of 30% in European stocks and 70% in U.S. stocks. If the VaR (99%), for some interval, of the European stocks is 1.93 percent, or $810,600, the VaR (99%) of U.S. stocks is 2.13 % or $2,087,400, and the correlation between the two stock portfolios is 0.64, calculate the 99% VaR, for the same interval, of the portfolio in percentage and dollar basis. 4. The 5-day 95% VaR of a firm is estimated to be 1.0 Million SGD. The firm currently has 24 Million in asset value, and the value of debt is estimated to be 20 million. Assuming zero mean returns for the equity value, what is the probability that the value of the equity will be negative after four months? 5. The Fund of Singapore is a portfolio that consists of 50% in bonds and 50% in stocks. The manager recently estimated the 10-day 95%-VaR to be $1,885,000. The market value is $15,428,000, and the correlation coefficient between stocks and bond returns is zero. If the daily loss in the equity position is expected to lose more than $1,193,000 5% of the time, What is the daily expected loss in the bond position that will be exceeded 5% of the time? 7. Your investment of $110 portfolio will have the following terminal value according to the probability given Value 130 105 99 97 94 70 35 Probability 0.4 0.2 0.2 0.1 0.04 0.03 0.03 Calculate the 95% VaR and 95% ES in dollar values, respectively, for the given time period. 8. The returns of Singtel is normally distributed with an expected return of 9% and a standard deviation of 25% per year. The stock is currently traded at $100. There is a put option with a strike price of 100, with a premium of $3, with an expiration of a year. The 95% VaR of a long of the put option is X dollars. The 95% VaR of the short position of a put option is Y dollars. What are X and Y?

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 To calculate the 5day 99 VaR in percentage points we can use the formula VaR portfolio value sqrtvariance zscore where zscore inverse of the cumulative distribution function of the standard ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started