Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susan purchased a 5-year Treasury bond with a coupon rate of j2 = 5% p.a. and a face value of $100 that matures at

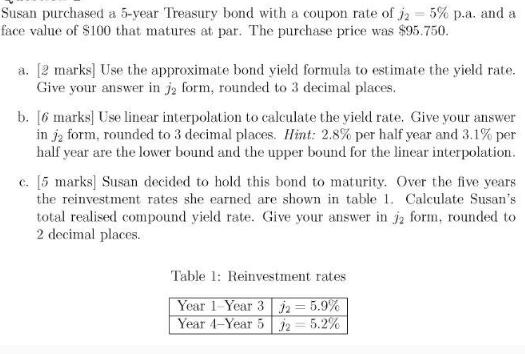

Susan purchased a 5-year Treasury bond with a coupon rate of j2 = 5% p.a. and a face value of $100 that matures at par. The purchase price was $95.750. a. [2 marks] Use the approximate bond yield formula to estimate the yield rate. Give your answer in j form, rounded to 3 decimal places. b. [6 marks] Use linear interpolation to calculate the yield rate. Give your answer in ja form, rounded to 3 decimal places. Hint: 2.8% per half year and 3.1% per half year are the lower bound and the upper bound for the linear interpolation. c. [5 marks] Susan decided to hold this bond to maturity. Over the five years the reinvestment rates she earned are shown in table 1. Calculate Susan's total realised compound yield rate. Give your answer in j form, rounded to 2 decimal places. Table 1: Reinvestment rates Year 1-Year 3 2 = 5.9% Year 4-Year 5 32-5.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started