Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susan wanted to rent a share in a ski house for the upcoming winter, a six-month season. The house owner would not allow Susan

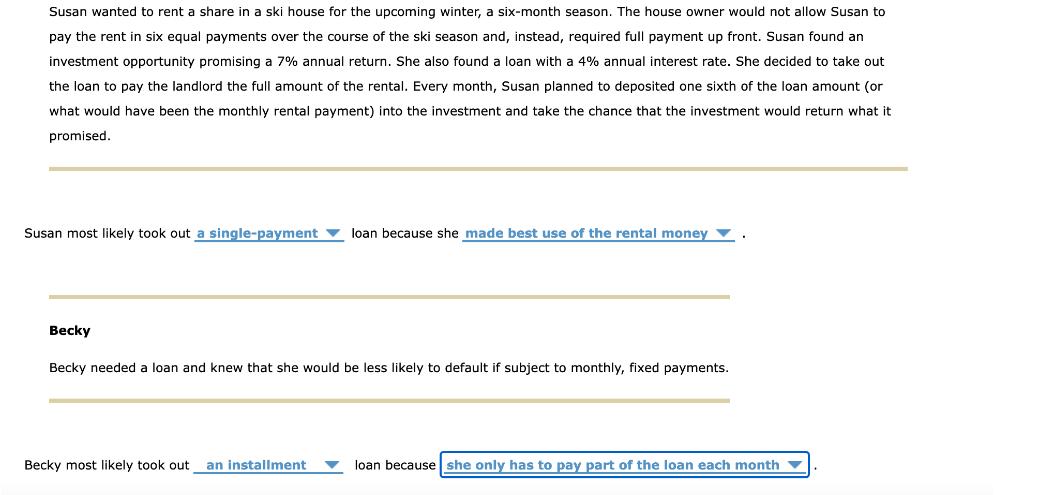

Susan wanted to rent a share in a ski house for the upcoming winter, a six-month season. The house owner would not allow Susan to pay the rent in six equal payments over the course of the ski season and, instead, required full payment up front. Susan found an investment opportunity promising a 7% annual return. She also found a loan with a 4% annual interest rate. She decided to take out the loan to pay the landlord the full amount of the rental. Every month, Susan planned to deposited one sixth of the loan amount (or what would have been the monthly rental payment) into the investment and take the chance that the investment would return what it promised. Susan most likely took out a single-payment loan because she made best use of the rental money Becky Becky needed a loan and knew that she would be less likely to default if subject to monthly, fixed payments. Becky most likely took out an installment loan because she only has to pay part of the loan each month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started